Understanding market cycles sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From the rollercoaster ride of economic ups and downs to the strategic dance of investors, this topic dives deep into the heartbeat of financial markets.

Introduction to Market Cycles

Market cycles in economics refer to the recurring patterns of growth, peak, decline, and trough in financial markets. These cycles are influenced by various factors such as economic conditions, investor sentiment, and government policies.

Types of Market Cycles

- Boom and Bust Cycles: These cycles are characterized by periods of rapid economic growth (boom) followed by sharp downturns (bust).

- Secular Cycles: Long-term trends lasting several years or decades, influenced by structural changes in the economy.

- Seasonal Cycles: Short-term fluctuations that occur predictably at certain times of the year, such as holiday shopping seasons.

Importance of Understanding Market Cycles for Investors

- Timing Investments: Recognizing where the market is in the cycle can help investors make informed decisions on when to buy or sell assets.

- Risk Management: Understanding market cycles can help investors anticipate potential downturns and adjust their portfolios accordingly to minimize losses.

- Opportunity Identification: Different phases of the market cycle present unique investment opportunities that savvy investors can capitalize on for potential gains.

Phases of Market Cycles

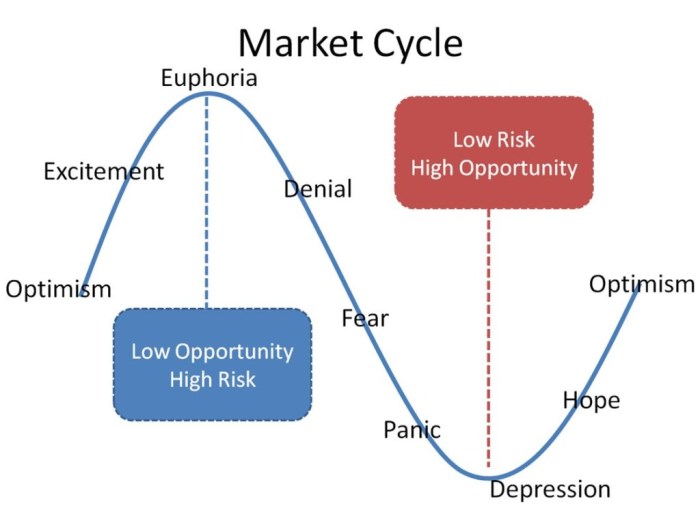

Market cycles typically consist of four main phases: Expansion, Peak, Contraction, and Trough. Each phase is characterized by specific trends and behaviors in the market.

Expansion Phase

During the Expansion phase, the market experiences growth and rising prices. Investor confidence is high, leading to increased buying activity. Companies see higher revenues and profits, resulting in positive economic indicators. This phase is marked by optimism and enthusiasm in the market.

Peak Phase

The Peak phase is when the market reaches its highest point. Prices are at their peak, and investor euphoria is at its peak as well. This is when speculation is rampant, and investors are overly optimistic about future returns. It’s a period of maximum financial risk as the market is vulnerable to a downturn.

Contraction Phase

In the Contraction phase, the market starts to decline. Prices begin to fall, and investor confidence wanes. This phase is characterized by fear and panic selling as investors try to protect their investments. Economic indicators turn negative, and there is an overall sense of pessimism in the market.

Trough Phase

The Trough phase is the lowest point in the market cycle. Prices have bottomed out, and investor sentiment is extremely negative. This phase is marked by high levels of uncertainty and a lack of confidence in the market. However, it’s also a period of opportunity for savvy investors looking to buy assets at low prices before the cycle starts again.

Influencing Factors

When it comes to market cycles, there are several key factors that play a significant role in influencing the direction and intensity of these cycles. External events, such as economic indicators, and investor sentiment are crucial components that impact market cycles in various ways.

Economic Indicators

- Economic indicators, such as GDP growth, unemployment rates, and inflation levels, can have a direct impact on market cycles.

- Positive economic indicators often lead to increased investor confidence, resulting in bull markets, while negative indicators can trigger bear markets.

- Market participants closely monitor economic data releases to gauge the health of the economy and make informed investment decisions.

Investor Sentiment

- Investor sentiment refers to the overall attitude or feeling of investors towards the market and specific assets.

- Positive sentiment can drive buying activity, pushing prices higher, while negative sentiment can lead to selling pressure and price declines.

- The collective behavior of investors, influenced by emotions like fear and greed, can cause market cycles to deviate from fundamental values.

Strategies for Navigating Market Cycles

Investors need to be strategic when navigating market cycles to maximize their returns and minimize risks. By understanding the different phases of market cycles and the influencing factors, investors can tailor their investment strategies accordingly.

Diversification

Diversification is key in navigating market cycles as it helps spread risk across different asset classes. By having a diversified portfolio, investors can protect themselves from the volatility of the market and reduce the impact of any downturn in a specific sector. It is important to have a mix of stocks, bonds, real estate, and other assets to ensure a well-rounded portfolio.

Buy Low, Sell High

One common strategy during market cycles is to buy low and sell high. This means that investors should look to invest in undervalued assets during market downturns when prices are low and sell when prices are high during bull markets. This strategy requires patience and a keen understanding of market trends.

Asset Allocation

Another strategy is to adjust asset allocation based on market cycles. For example, during a bear market, investors may choose to shift their investments towards defensive sectors like consumer staples and healthcare. Conversely, during a bull market, they may increase exposure to growth sectors like technology and consumer discretionary.

Market Timing

While market timing can be risky, some investors choose to adjust their portfolios based on market cycles. This involves closely monitoring economic indicators and market trends to make informed decisions about when to buy or sell assets. However, it is important to note that market timing is not always accurate and can lead to missed opportunities or losses.

Long-Term Investing

Lastly, adopting a long-term investing approach can help navigate market cycles. By focusing on the overall performance of the portfolio over time, rather than short-term fluctuations, investors can ride out market volatility and benefit from the compounding effect of long-term investments.