Diving into the world of finance, Understanding financial ratios is like deciphering a complex code that reveals a company’s true performance. Get ready to explore the key to unlocking financial success with this breakdown of ratios and their significance.

From liquidity to profitability, solvency to efficiency, we’ll break down the types of financial ratios and how they impact investment decisions.

Importance of Financial Ratios

Financial ratios are crucial tools used by investors and analysts to evaluate a company’s performance. These ratios provide valuable insights into various aspects of a company’s financial health, allowing stakeholders to make informed decisions.

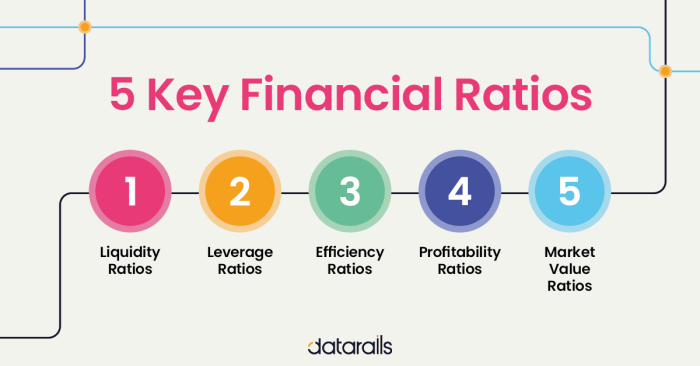

Key Financial Ratios

- Liquidity Ratios: Examples include the current ratio and quick ratio, which assess a company’s ability to meet short-term obligations.

- Profitability Ratios: Return on Equity (ROE) and Net Profit Margin are commonly used to measure a company’s profitability and efficiency.

- Debt Ratios: Debt-to-Equity ratio and Interest Coverage ratio help in evaluating a company’s leverage and debt repayment capacity.

- Efficiency Ratios: Inventory Turnover and Asset Turnover ratios indicate how effectively a company utilizes its resources.

Informed Investment Decisions

Financial ratios play a vital role in helping investors make informed investment decisions. By analyzing these ratios, investors can compare companies within the same industry, identify trends, and assess the overall financial health of a company. This analysis enables investors to mitigate risks and maximize returns on their investments.

Types of Financial Ratios

Financial ratios are essential tools used by investors, analysts, and companies to evaluate the financial health and performance of a business. These ratios can be categorized into four main types: liquidity ratios, profitability ratios, solvency ratios, and efficiency ratios.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. They provide insight into the company’s ability to cover its current liabilities with its current assets.

- Current Ratio: Calculated by dividing current assets by current liabilities, this ratio indicates whether a company can pay off its short-term debts with its current assets.

- Quick Ratio: Also known as the acid-test ratio, this ratio considers only the most liquid assets when measuring a company’s ability to cover short-term obligations.

Profitability Ratios

Profitability ratios measure a company’s ability to generate profits relative to its revenue, assets, and equity.

- Net Profit Margin: Calculated by dividing net income by revenue, this ratio shows how much of each dollar earned by the company translates to profit.

- Return on Assets (ROA): This ratio indicates how effectively a company utilizes its assets to generate profit.

Solvency Ratios

Solvency ratios assess a company’s long-term financial stability and its ability to meet long-term obligations.

- Debt-to-Equity Ratio: This ratio shows the proportion of debt and equity a company is using to finance its assets.

- Interest Coverage Ratio: Indicates a company’s ability to cover interest expenses with its earnings before interest and taxes (EBIT).

Efficiency Ratios

Efficiency ratios measure how well a company utilizes its assets and liabilities to generate sales and revenue.

- Asset Turnover Ratio: This ratio indicates how efficiently a company uses its assets to generate revenue.

- Inventory Turnover Ratio: Shows how many times a company sells and replaces its inventory within a specific period.

Interpreting Financial Ratios

When it comes to interpreting financial ratios, it’s crucial to compare them with industry benchmarks and historical data to get a clear picture of a company’s financial standing. By analyzing these ratios in context, you can uncover valuable insights into the company’s performance and make informed decisions.

Understanding Industry Benchmarks

- Industry benchmarks provide a standard for comparison, allowing you to see how a company’s ratios stack up against its peers.

- Deviation from industry norms can indicate areas where a company is excelling or falling behind.

- For example, a higher profit margin compared to industry averages may suggest a competitive advantage or superior cost management.

Analyzing Trends in Financial Ratios

- Tracking changes in financial ratios over time can reveal patterns that signal a company’s financial health.

- Consistent improvement or deterioration in ratios may indicate underlying strengths or weaknesses in the company’s operations.

- For instance, a declining liquidity ratio over several quarters could signal cash flow issues or inefficient working capital management.

Identifying Strengths and Weaknesses

- Through financial ratio analysis, you can pinpoint areas of strength and weakness within a company.

- Comparing different ratios can help you assess overall performance and identify areas that require attention or improvement.

- For instance, a high debt-to-equity ratio may indicate excessive leverage, while a high return on equity could signify efficient capital utilization.

Limitations of Financial Ratios

Financial ratios are valuable tools for analyzing a company’s financial health, but they do have their limitations. Relying solely on financial ratios to assess a company’s performance can present a skewed picture of its overall financial status.

Impact of External Factors

External factors such as changes in the economic environment, industry trends, or regulatory changes can significantly impact the accuracy of financial ratios. For example, a sudden shift in market conditions could distort the ratios and mislead investors or analysts.

Accounting Methods and Assumptions

Different accounting methods and assumptions used by companies can also affect the reliability of financial ratios. For instance, companies may use different depreciation methods or inventory valuation techniques, leading to inconsistencies in the ratios calculated.

Timing of Financial Data

The timing of financial data can also be a limitation when using financial ratios. Ratios are based on historical financial information, which may not reflect the current financial position of a company. This lag in data can make it challenging to make real-time decisions based on ratios alone.

Complex Business Structures

Financial ratios may not provide a complete picture of a company’s financial status when dealing with complex business structures. For example, conglomerates with diverse business segments may have varying financial performance within each segment, making it difficult to assess the overall health of the company using ratios alone.

Example Scenario

An example where financial ratios may fall short is when a company has high levels of intangible assets, such as patents or brand value. These assets may not be accurately reflected in traditional financial ratios, leading to an incomplete assessment of the company’s value and performance.