Diving into the realm of Trends in financial technology (fintech), this introduction will take you on a wild ride through the latest and greatest in the fintech world. Brace yourself for a rollercoaster of innovation and disruption that will leave you craving more.

In the following paragraphs, we’ll explore the ins and outs of how fintech is reshaping the financial landscape and what the future holds for this dynamic industry.

Overview of Financial Technology (Fintech)

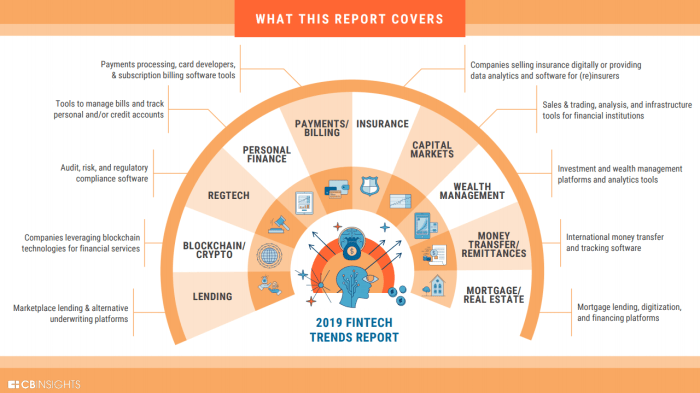

Fintech, short for financial technology, refers to the innovative use of technology to deliver financial services in a more efficient and effective manner. It encompasses a wide range of applications, from mobile banking and peer-to-peer lending to blockchain and cryptocurrency. Fintech has gained significant traction in recent years, disrupting traditional financial institutions and reshaping the way we manage our money.

Significance of Fintech in the Financial Industry

- Fintech companies leverage cutting-edge technology to provide faster, cheaper, and more convenient financial services to consumers and businesses.

- By streamlining processes and reducing costs, fintech is democratizing access to financial services and promoting financial inclusion for underserved populations.

- Traditional banks and financial institutions are facing increased competition from nimble fintech startups, forcing them to innovate and adapt to meet changing consumer demands.

Examples of Popular Fintech Companies and Their Services

- Stripe: A payment processing platform that allows businesses to accept online payments seamlessly.

- Robinhood: A commission-free stock trading app that has democratized investing for the masses.

- PayPal: An online payment system that enables individuals and businesses to send and receive money electronically.

- Square: Known for its point-of-sale solutions and small business services, including Square Cash for peer-to-peer payments.

Evolving Trends in Fintech

The fintech industry is constantly evolving, with new trends emerging that shape the landscape of financial technology. From artificial intelligence to blockchain technology, these advancements are revolutionizing the way we think about finance.

Impact of Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning have had a profound impact on fintech, enabling companies to streamline processes, improve customer service, and make more informed decisions. By analyzing vast amounts of data in real-time, AI algorithms can detect patterns and trends that humans might miss, leading to more accurate predictions and personalized recommendations for users.

Role of Blockchain Technology in Fintech Innovations

Blockchain technology is another key trend in fintech, offering secure and transparent transactions without the need for intermediaries. By creating decentralized ledgers that record all transactions in a tamper-proof manner, blockchain has the potential to revolutionize the way we exchange value and verify ownership. This technology is being leveraged in areas such as digital currencies, smart contracts, and supply chain management, paving the way for a more efficient and secure financial system.

Fintech Applications

Fintech applications have revolutionized the way we handle financial transactions and manage our money. From traditional banking services to cutting-edge payment methods, fintech is making a significant impact across various sectors.

Changing Payment Methods

Fintech has transformed the way we make payments by introducing innovative solutions such as mobile wallets, peer-to-peer payment platforms, and contactless payment options. These technologies offer convenience, speed, and security, making transactions easier for consumers and businesses alike.

Personal Finance Management

Fintech plays a crucial role in personal finance management by providing tools and platforms for budgeting, saving, investing, and tracking expenses. With the help of fintech apps and software, individuals can gain better insights into their financial health and make informed decisions to achieve their financial goals.

Regulatory Challenges in Fintech

In the fast-paced world of financial technology (fintech), companies face numerous regulatory challenges that can impact their operations and growth. Let’s delve into the key issues surrounding fintech regulations and how different countries are approaching them.

Regulatory Challenges Faced by Fintech Companies

- Fintech companies often operate across borders, making it difficult to comply with varying regulatory requirements in different countries.

- Regulatory uncertainty can hinder innovation and investment in the fintech sector, as companies may be unsure of how to navigate complex regulations.

- Data privacy and security regulations pose a significant challenge for fintech companies, as they handle sensitive financial information that must be protected.

Approaches to Fintech Regulations in Different Countries

- The United States has a fragmented regulatory framework for fintech, with different agencies regulating various aspects of the industry.

- In the European Union, the introduction of the Payment Services Directive (PSD2) has aimed to create a level playing field for fintech companies while ensuring consumer protection.

- Countries like Singapore and the United Kingdom have implemented regulatory sandboxes to allow fintech companies to test innovative products in a controlled environment before full compliance is required.

Importance of Regulatory Compliance in the Fintech Industry

- Regulatory compliance is crucial for fintech companies to build trust with consumers and investors, as it demonstrates a commitment to following rules and regulations.

- Failure to comply with regulations can result in hefty fines, reputational damage, or even the shutdown of a fintech business, highlighting the importance of staying compliant.

- Working closely with regulators and staying informed about evolving regulations is essential for fintech companies to navigate the complex regulatory landscape successfully.

Fintech and Cybersecurity

In the world of financial technology (fintech), cybersecurity plays a crucial role in protecting sensitive data, preventing fraud, and maintaining trust with customers. As fintech companies continue to innovate and expand their digital services, the need for robust cybersecurity measures becomes increasingly important to ensure the security and integrity of financial transactions.

Significance of Cybersecurity in Fintech

- Cybersecurity is essential in fintech to protect customer data, financial transactions, and sensitive information from cyber threats.

- Ensuring strong cybersecurity measures helps fintech companies build trust with customers and maintain a positive reputation in the industry.

- A breach in cybersecurity can have severe consequences, including financial losses, damage to brand reputation, and legal liabilities.

Common Cybersecurity Threats in Fintech

-

Phishing attacks:

Cybercriminals use deceptive emails or messages to trick individuals into revealing sensitive information, such as login credentials or financial details.

-

Malware:

Malicious software designed to infiltrate systems, steal data, or disrupt operations poses a significant threat to fintech companies.

-

Insider threats:

Employees or individuals with access to sensitive information may intentionally or unintentionally compromise cybersecurity measures.

Best Practices for Ensuring Cybersecurity in Fintech

- Implementing robust encryption protocols to protect data in transit and at rest.

- Regularly conducting security assessments and penetration testing to identify vulnerabilities and strengthen defenses.

- Training employees on cybersecurity best practices and raising awareness about potential threats.

- Collaborating with cybersecurity experts and staying up-to-date on the latest security trends and technologies.