Strategies for negotiating financial terms sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Get ready to dive into the world of financial negotiations with a fresh perspective!

As we delve deeper into the intricacies of financial terms and negotiations, a wealth of knowledge awaits those seeking to master this art form.

Understanding Financial Terms

In the world of negotiations, understanding financial terms is crucial for reaching favorable outcomes. Whether you’re discussing a loan, investment, or business deal, having a grasp of financial jargon can make or break a deal. Let’s delve into the significance of understanding financial terms and explore some common terms used in negotiations.

Defining Financial Terms

Financial terms are specialized words and phrases used to describe various aspects of money management and transactions. These terms provide a common language for discussing financial matters, ensuring clarity and precision in negotiations. Without a solid understanding of financial terms, miscommunication and misunderstandings can arise, leading to costly mistakes.

Significance of Understanding Financial Jargon

Being fluent in financial jargon allows you to navigate complex negotiations with confidence. It empowers you to ask the right questions, analyze proposals effectively, and make informed decisions. By understanding financial terms, you can negotiate better terms, identify potential risks, and ultimately secure a more favorable outcome.

Common Financial Terms in Negotiations

- ROI (Return on Investment): This metric measures the profitability of an investment relative to its cost. Understanding ROI helps you assess the potential returns of a financial decision.

- Interest Rate: The percentage charged by a lender for borrowing money. Negotiating a lower interest rate can save you money over time.

- Amortization: The process of paying off a debt over time through regular payments. Knowing the amortization schedule can help you plan your finances effectively.

- Collateral: Assets pledged as security for a loan. Understanding collateral requirements is crucial in negotiations involving loans or credit.

Impact of Financial Terms on Negotiations

Financial terms can significantly impact the negotiation process. For example, a higher interest rate can increase the overall cost of borrowing, affecting your bottom line. On the other hand, negotiating favorable terms such as a longer repayment period or lower fees can lead to substantial savings. By leveraging your understanding of financial terms, you can advocate for terms that align with your financial goals and interests.

Preparation for Negotiations

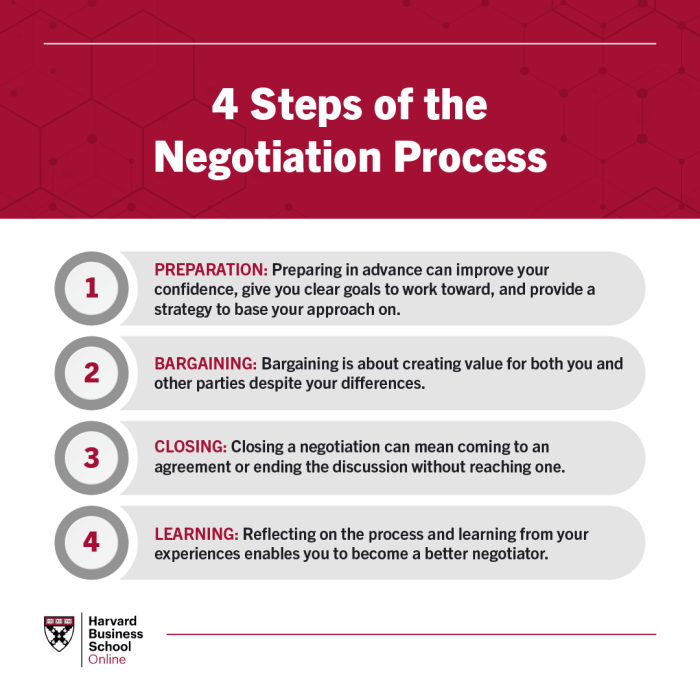

Before entering into financial negotiations, it is crucial to be well-prepared. This includes gathering and analyzing financial information, researching terms, and setting clear goals for the negotiation process. Adequate preparation can give you a strategic advantage and increase the likelihood of achieving a favorable outcome.

Researching Financial Terms

- Start by familiarizing yourself with common financial terms related to the negotiation.

- Utilize online resources, financial publications, and industry reports to deepen your understanding.

- Consider consulting with financial experts or advisors to clarify any complex terms.

Analyzing the Financial Position of the Other Party

- Review publicly available financial statements, reports, and press releases of the other party.

- Assess their financial stability, debt levels, profitability, and overall financial health.

- Identify any potential weaknesses or vulnerabilities that could be leveraged during negotiations.

Setting Clear Financial Goals

- Evaluate your financial priorities and objectives for the negotiation.

- Determine your ideal financial outcomes and acceptable concessions.

- Establish specific, measurable, and realistic financial goals to guide your negotiation strategy.

Effective Communication in Negotiations

Effective communication of financial terms during negotiations is crucial for reaching mutually beneficial agreements. Clear and concise communication helps in avoiding misunderstandings and ensures that all parties are on the same page when discussing financial terms.

Explaining Complex Financial Terms

Explaining complex financial terms clearly can be achieved by breaking down the terms into simpler language that is easy to understand. Use analogies or real-life examples to illustrate the concepts behind the terms. This approach helps in making the information more relatable and accessible to all parties involved.

- Use real-life examples to illustrate complex financial terms.

- Break down the terms into simpler language.

- Provide analogies to help explain the concepts behind the terms.

Role of Active Listening

Active listening plays a vital role in understanding financial terms during negotiations. By actively listening to the other party’s explanations and concerns, you can gain valuable insights into their perspective and better comprehend the financial terms being discussed. This helps in building rapport and fostering a more collaborative negotiation process.

- Listen attentively to the other party’s explanations and concerns.

- Acknowledge their points to show that you are actively listening.

- Ask clarifying questions to ensure a complete understanding of the financial terms.

Impact of Miscommunication

Miscommunication of financial terms can have detrimental effects on negotiations, leading to misunderstandings, confusion, and potential disagreements. For example, if one party misinterprets a financial term, it could result in a breakdown of trust and hinder the progress of the negotiation process. It is essential to clarify any misunderstandings promptly to avoid such pitfalls.

- Miscommunication can lead to misunderstandings and confusion.

- It may result in a breakdown of trust between parties.

- Clarify any misunderstandings promptly to prevent negative impacts on negotiations.

Creating Win-Win Solutions

When it comes to negotiating financial terms, creating win-win solutions is key to ensuring both parties are satisfied with the outcome. By identifying mutually beneficial terms, finding common ground, being flexible, and providing examples of win-win solutions, negotiations can be successful for all involved.

Identifying Mutually Beneficial Financial Terms

In order to create a win-win solution, it is important to identify financial terms that are beneficial for both parties. This involves understanding each other’s needs, priorities, and limitations. By actively listening and asking the right questions, negotiators can uncover opportunities for compromise and mutual gain.

Strategies for Finding Common Ground

One effective strategy for finding common ground on financial terms is to focus on interests rather than positions. By exploring the underlying reasons behind each party’s demands, negotiators can uncover shared goals and objectives. This allows for creative solutions that meet the needs of both parties without compromising on core values.

- Focus on interests, not positions

- Explore shared goals and objectives

- Be open to creative solutions

The Importance of Flexibility

Flexibility is crucial in negotiating financial terms because it allows for adjustments and compromises to be made along the way. By remaining open to new ideas and willing to adapt to changing circumstances, negotiators can avoid deadlocks and find innovative solutions that benefit everyone involved.

Flexibility is the key to finding win-win solutions in negotiations.

Examples of Win-Win Solutions

– Agreeing on a payment plan that meets the needs of both parties

– Offering discounts or incentives in exchange for long-term commitments

– Sharing risks and rewards in a mutually beneficial way