Yo, listen up! Portfolio diversification is like the secret sauce for investors, blending different ingredients to cook up a winning recipe. It’s all about spreading your investments to reduce risk and maximize those sweet returns. So, buckle up and let’s dive into this dope topic!

Now, let’s break it down and explore the ins and outs of portfolio diversification.

Importance of Portfolio Diversification

Investors, listen up! Diversifying your portfolio is like having a variety pack of snacks – it’s essential for minimizing risk and maximizing returns in the unpredictable world of finance. Let’s break it down further, shall we?

Reducing Risk with Diversification

When you put all your eggs in one basket, you’re setting yourself up for disaster if that basket takes a tumble. By spreading your investments across different asset classes like stocks, bonds, and real estate, you can cushion the blow if one sector tanks. It’s like having a safety net for your hard-earned cash.

Enhancing Returns through Diversification

Not only does diversification help protect your investments, but it can also boost your overall returns. By including a mix of high-risk, high-reward assets with more stable ones, you create a well-rounded portfolio that can weather market fluctuations and potentially bring in higher profits. It’s all about striking that perfect balance, folks.

Strategies for Portfolio Diversification

Diversifying your portfolio is essential to manage risk and potentially increase returns by investing in a variety of assets. Here are some key strategies for portfolio diversification:

Different Asset Classes for Diversification

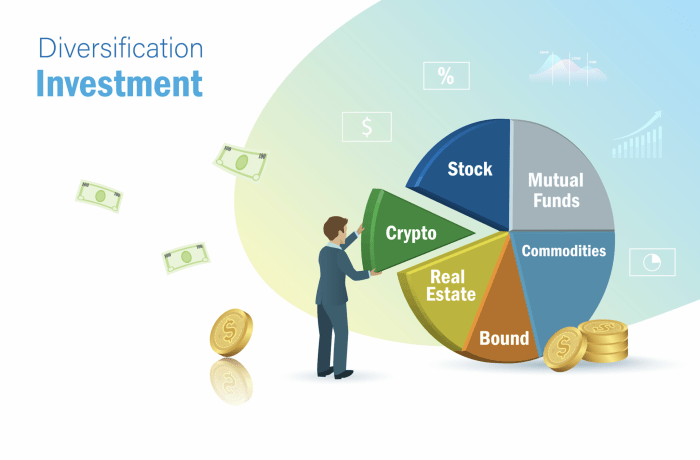

When diversifying your portfolio, it’s important to consider different asset classes such as:

- Stocks: Investing in a mix of large-cap, mid-cap, and small-cap stocks can help spread risk.

- Bonds: Including government, corporate, and municipal bonds can provide stability to your portfolio.

- Real Estate: Investing in real estate properties or real estate investment trusts (REITs) can add diversification.

- Commodities: Adding commodities like gold, silver, or oil can help hedge against inflation and market volatility.

Remember, diversifying across various asset classes can help reduce the impact of a downturn in any single market.

Concept of Correlation in Portfolio Diversification

Correlation measures how closely the price movements of two assets are related. A correlation of +1 means two assets move in perfect harmony, while a correlation of -1 means they move in opposite directions. When diversifying your portfolio, it’s important to choose assets with low or negative correlations to spread risk effectively.

Implementing Geographic Diversification

Geographic diversification involves investing in assets across different regions or countries to reduce exposure to any single economy. Examples of how geographic diversification can be implemented include:

- Investing in international stocks or mutual funds that focus on specific regions like Europe, Asia, or emerging markets.

- Allocating a portion of your portfolio to global bonds or currency investments to take advantage of opportunities in different regions.

- Considering international real estate investments through REITs or direct property ownership in foreign markets.

Risk Management through Diversification

Diversification plays a crucial role in managing risks within an investment portfolio. By spreading investments across different asset classes, industries, and geographical regions, investors can reduce the impact of any single asset underperforming or facing a downturn.

Impact of Diversification on Volatility

Diversification helps in lowering the overall volatility of a portfolio. When one asset class is experiencing a decline, other assets in the portfolio may be performing well, balancing out the losses and reducing the overall risk exposure. This can lead to a smoother and more stable investment journey.

- Diversification can help in mitigating the impact of market fluctuations on the portfolio.

- It reduces the correlation between assets, lowering the overall risk exposure.

- By investing in a mix of assets with different risk profiles, investors can achieve a more balanced and resilient portfolio.

Strategies for Managing Risks through Diversification

Implementing diversification strategies is essential for effective risk management in an investment portfolio. Here are some key strategies to consider:

- Asset Allocation: Allocate investments across different asset classes such as stocks, bonds, real estate, and commodities to spread risk.

- Industry Diversification: Invest in companies from various industries to avoid concentration risk in a single sector.

- Geographical Diversification: Spread investments across different regions and countries to reduce exposure to country-specific risks.

- Rebalancing: Regularly review and rebalance the portfolio to maintain the desired asset allocation and risk level.

Challenges and Considerations in Portfolio Diversification

When it comes to diversifying a portfolio, there are several challenges that investors may face along with important considerations to keep in mind to maintain a well-diversified portfolio. Let’s delve into some of these challenges and considerations below.

Common Challenges Faced in Portfolio Diversification

- Overlapping Investments: Sometimes, investors may unknowingly have similar investments in different asset classes, which can reduce the effectiveness of diversification.

- Lack of Research: Insufficient research or understanding of different asset classes can lead to poor diversification decisions.

- Market Volatility: Sudden shifts in market conditions can impact the performance of diversified portfolios, making it challenging to maintain a balanced mix of assets.

Considerations for Maintaining a Diversified Portfolio

- Regular Monitoring: It is crucial to regularly review and rebalance your portfolio to ensure that it remains diversified according to your investment goals and risk tolerance.

- Asset Allocation: Proper allocation of assets across different classes based on your financial objectives can help in maintaining a well-diversified portfolio.

- Risk Assessment: Continuously assess the risk exposure of your portfolio and make adjustments as needed to mitigate potential risks.

Impact of Market Conditions on Diversification Strategies

- Correlation Effects: During periods of economic downturn or market volatility, correlations between asset classes may increase, impacting the effectiveness of diversification.

- Interest Rate Changes: Shifts in interest rates can affect different asset classes differently, leading to changes in the performance of a diversified portfolio.

- Geopolitical Events: Political instability or global events can introduce uncertainty in the market, influencing the performance of various assets within a diversified portfolio.