With Investment diversification at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling American high school hip style filled with unexpected twists and insights.

Investment diversification is like building a killer mixtape – you gotta have a variety of tracks to keep the vibes fresh and the hits coming. In this game, it’s all about spreading your funds across different types of investments to maximize gains and minimize losses. So grab your shades and let’s dive into the world of diversifying your investments like a pro.

What is Investment Diversification?

Investment diversification is a strategy where an investor spreads their money across different types of assets to reduce risk and increase potential returns. By diversifying their portfolio, investors can minimize the impact of a downturn in any one investment.

Importance of Diversifying an Investment Portfolio

Diversifying an investment portfolio is crucial for managing risk and maximizing returns. It helps protect against significant losses that may occur if one asset class underperforms. Here are some key reasons why diversification is important:

- Diversification reduces the overall risk of the portfolio by spreading investments across different asset classes.

- It helps to capture the performance of different sectors of the market, potentially increasing overall returns.

- By diversifying, investors can hedge against inflation, market volatility, and economic uncertainties.

Examples of Asset Classes in a Diversified Portfolio

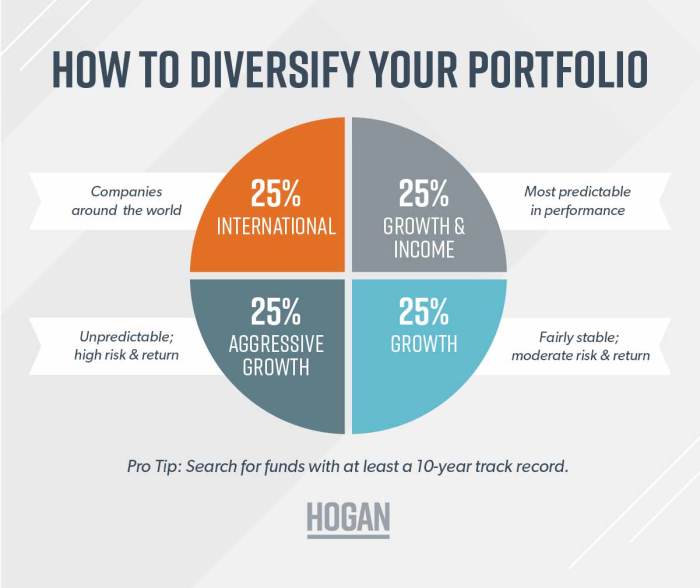

When building a diversified investment portfolio, investors can consider including a mix of the following asset classes:

- Stocks: Investing in stocks of different companies across various industries.

- Bonds: Allocating funds to government or corporate bonds with different maturities and credit ratings.

- Real Estate: Including investments in real estate properties or Real Estate Investment Trusts (REITs).

- Commodities: Investing in physical goods like gold, oil, or agricultural products to hedge against inflation.

- Alternative Investments: Adding assets like hedge funds, private equity, or cryptocurrencies for diversification.

Strategies for Investment Diversification

Diversifying investments is a crucial strategy to reduce risk and maximize returns. By spreading your investments across different assets, you can protect your portfolio from fluctuations in any single market. Let’s explore some key strategies for effective investment diversification.

Asset Allocation vs. Diversification

Asset allocation involves dividing your investments among different asset classes such as stocks, bonds, real estate, and cash. This strategy helps you manage risk by balancing the potential returns and volatility of each asset class. On the other hand, diversification focuses on spreading investments within each asset class. For example, if you invest in stocks, you can diversify by buying shares of companies from various sectors. Both asset allocation and diversification are essential components of a well-rounded investment strategy.

Risk Management through Investment Diversification

Diversification plays a key role in risk management by reducing the impact of market volatility on your portfolio. By spreading your investments across different assets, you can minimize the risk of losing a significant portion of your capital due to a downturn in a single market. For example, if you only invest in one industry and it experiences a downturn, your entire portfolio could be at risk. However, by diversifying across industries, you can protect yourself from sector-specific risks.

Benefits of Investment Diversification

Diversifying your investment portfolio comes with several advantages that can help you manage risk and potentially enhance your returns over the long term.

Reducing Overall Investment Risk

Diversification is key to reducing the overall risk in your investment portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can minimize the impact of negative events on any single investment. For example, if one sector experiences a downturn, other investments in your portfolio may help offset those losses, reducing the overall risk exposure.

Enhancing Long-Term Returns

Diversification can also enhance your long-term returns by capturing the growth potential of different asset classes. For instance, while stocks may offer higher returns, they also come with higher volatility. By including bonds or real estate in your portfolio, you can balance out the risk and potentially achieve more stable returns over time. This balanced approach can help you achieve your financial goals while minimizing the impact of market fluctuations.

Challenges and Considerations

Investors face various challenges when diversifying their portfolios. It is crucial to understand these obstacles and how to overcome them to ensure a successful investment strategy.

Monitoring and Rebalancing

One common challenge in maintaining a diversified investment portfolio is the need for continuous monitoring and rebalancing. Market fluctuations and changes in asset values can affect the balance of your portfolio over time.

- Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance.

- Adjust the allocation of assets to maintain diversification and minimize risk exposure.

- Consider using automation tools or working with a financial advisor to streamline the monitoring and rebalancing process.

Overcoming Obstacles

Overcoming obstacles in the process of investment diversification requires careful planning and strategic decision-making.

- Diversify across different asset classes, industries, and geographic regions to reduce concentration risk.

- Stay informed about market trends and economic indicators to make well-informed investment decisions.

- Set realistic and achievable investment goals to guide your diversification strategy.

- Avoid making impulsive decisions based on short-term market fluctuations and focus on long-term investment objectives.