International stock markets set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Get ready to dive into the world of global finance like never before.

As we delve deeper, we’ll explore the inner workings of international stock markets, shedding light on their operation and the key players driving this dynamic arena.

Overview of International Stock Markets

International stock markets are platforms where individuals and institutions can buy and sell shares of publicly traded companies from around the world. These markets allow for the exchange of securities between buyers and sellers, facilitating global investment opportunities.

How International Stock Markets Operate

International stock markets operate electronically, with trades executed through computer networks. Investors can access these markets through brokerage firms or online trading platforms. Prices of stocks are determined by supply and demand, influenced by various factors such as economic indicators, geopolitical events, and company performance.

Key Players in International Stock Markets

- Investors: Individuals and institutions who buy and sell stocks in international markets to build wealth and diversify their portfolios.

- Stock Exchanges: Platforms where securities are traded, such as the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE).

- Regulators: Government agencies that oversee and regulate the operations of international stock markets to ensure fair and transparent trading practices.

- Companies: Publicly traded corporations that offer shares to investors in international markets to raise capital for business operations.

Importance of International Stock Markets

International stock markets play a crucial role in the global economy, providing opportunities for investors to diversify their portfolios and access a wide range of investment options. These markets facilitate the flow of capital across borders, promoting economic growth and development on a global scale.

Comparison with Domestic Markets

When comparing the performance of international stock markets with domestic markets, it is important to consider factors such as market size, liquidity, volatility, and regulatory environment. International markets often offer greater diversification benefits due to exposure to different industries, currencies, and geopolitical factors. However, they may also pose higher risks related to currency fluctuations and political instability.

Impact on Multinational Corporations

International stock markets have a significant impact on multinational corporations, providing them with access to capital from a global investor base. These markets allow companies to raise funds for expansion, acquisitions, and research and development activities. Moreover, listing on international stock exchanges can enhance a company’s visibility and credibility in the global marketplace, attracting potential partners, customers, and investors.

Major International Stock Exchanges

When it comes to international stock exchanges, there are several key players that dominate the global financial markets. These exchanges serve as crucial platforms for buying and selling stocks, bonds, and other securities on a global scale.

List and describe some of the largest international stock exchanges

- New York Stock Exchange (NYSE): The NYSE is one of the oldest and largest stock exchanges in the world, with a market capitalization of over $30 trillion. It is home to some of the biggest companies globally.

- NASDAQ: Known for its focus on technology and growth stocks, NASDAQ is another major stock exchange in the United States. It boasts a market cap of around $11 trillion.

- Tokyo Stock Exchange (TSE): The largest stock exchange in Japan, TSE plays a significant role in the Asian financial markets, with a market cap exceeding $6 trillion.

- London Stock Exchange (LSE): LSE is one of the most prominent stock exchanges in Europe, with a market cap of approximately $4 trillion. It attracts investors from around the world.

Compare the trading volumes of different international stock exchanges

Trading volumes in international stock exchanges can vary significantly based on factors such as market activity, investor sentiment, and economic conditions. Generally, exchanges with higher trading volumes tend to be more liquid and attract more investors.

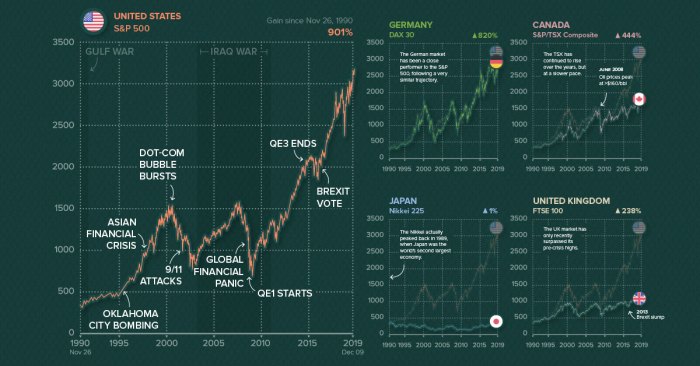

Explain how global events impact international stock exchanges

Global events such as geopolitical tensions, economic indicators, natural disasters, and political developments can have a profound impact on international stock exchanges. These events can influence investor confidence, market volatility, and overall trading activity on a global scale. For example, a trade war between two major economies can lead to market sell-offs and increased volatility, affecting stock prices worldwide.

Factors Influencing International Stock Markets

Geopolitical factors, economic indicators, and technological advancements all play a crucial role in shaping international stock markets.

Geopolitical Factors

Geopolitical factors such as wars, political instability, trade agreements, and diplomatic relations between countries can have a significant impact on international stock markets. For example, the imposition of tariffs in a trade war between two major economies can lead to market volatility and uncertainty.

Economic Indicators

Economic indicators such as GDP growth, interest rates, inflation, and unemployment rates can greatly influence international stock markets. Positive economic data can boost investor confidence, leading to higher stock prices, while negative data can result in market downturns.

Technology and Innovation

Technology and innovation play a vital role in shaping international stock markets by providing new investment opportunities, improving market efficiency, and enhancing global connectivity. For instance, the rise of fintech companies and the adoption of blockchain technology have transformed the way financial transactions are conducted, impacting stock market dynamics.