Yo, peeps! So, we’re diving into the world of income tax on investments. Get ready to navigate through the twists and turns of how your investment gains can affect your tax situation. It’s like a puzzle, but we got the pieces to help you put it all together.

Let’s break it down from how different investments are taxed to what deductions and credits you can snag. So, grab your shades and get ready to shine light on this crucial financial topic.

What is income tax on investments?

Income tax on investments refers to the taxes imposed on the income generated from various types of investments. This tax is applied to the earnings received from investments such as stocks, bonds, mutual funds, real estate, and more.

Types of taxable investment income

- Interest Income: This includes interest earned from savings accounts, CDs, bonds, and other fixed-income investments.

- Dividend Income: Income received from owning stocks or mutual funds that pay dividends is taxable.

- Capital Gains: Profits from selling investments such as stocks, real estate, or other assets are subject to capital gains tax.

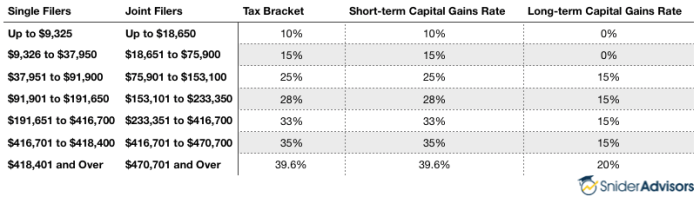

Tax rates on investment income can vary based on the duration of the investment and the type of investment. Short-term capital gains are typically taxed at a higher rate than long-term capital gains.

Types of investments subject to income tax

When it comes to investments, different types can have varying tax implications. Let’s break down how common investments like stocks, bonds, real estate, and others are taxed differently.

Stocks

Stocks are usually subject to capital gains tax when sold. The tax rate depends on how long you held the stock. Short-term investments, held for less than a year, are taxed at ordinary income tax rates. On the other hand, long-term investments, held for more than a year, are taxed at lower capital gains tax rates.

Bonds

Interest earned from bonds is typically taxed as ordinary income. This means that the tax rate is based on your income tax bracket. However, some municipal bonds may be exempt from federal income tax, providing a tax advantage for investors.

Real Estate

Income generated from real estate investments, such as rental properties, is usually subject to income tax. Additionally, any capital gains from selling real estate are also taxed, with the tax rate depending on how long the property was held.

Mutual Funds

Mutual funds can generate income in the form of dividends, interest, or capital gains. These earnings are typically subject to taxation, similar to stocks and bonds. The tax treatment can vary based on the type of income generated by the mutual fund.

Comparison of Short-term vs Long-term Investments

When it comes to the tax implications of short-term vs long-term investments, the key difference lies in the tax rates. Short-term investments are taxed at ordinary income tax rates, which can be higher than the tax rates for long-term investments. By holding investments for longer periods, investors can benefit from lower capital gains tax rates, reducing their overall tax burden.

Tax deductions and credits related to investment income

When it comes to taxes on investment income, there are deductions and credits that can help reduce the amount you owe to the IRS. Understanding these tax breaks is essential for maximizing your investment returns and minimizing your tax liability.

Deductions for Investment-Related Expenses

Investors can deduct certain investment-related expenses from their taxable income. These expenses may include fees paid to financial advisors, custodial fees, and expenses related to managing your investments. Keeping track of these costs throughout the year can help lower your taxable income and ultimately reduce your tax bill.

Offsetting Taxable Gains with Investment Losses

When you sell an investment at a loss, you can use that loss to offset any taxable gains you may have realized during the year. This strategy, known as tax-loss harvesting, allows you to reduce your overall tax liability by balancing out your gains with losses. Keep in mind that there are specific rules and limitations regarding the use of investment losses for tax purposes, so it’s essential to consult with a tax professional for guidance.

Tax Credits for Specific Types of Investments

Certain types of investments may qualify for tax credits, which directly reduce the amount of tax you owe. For example, investments in renewable energy projects or low-income housing developments may be eligible for tax credits that can lower your tax bill. These credits are designed to incentivize investment in particular sectors that benefit the economy or the environment. Be sure to research and understand the eligibility requirements for any tax credits associated with your investments to take full advantage of these opportunities.

Reporting investment income on tax returns

When it comes to reporting investment income on your tax returns, it is crucial to be accurate and organized. This ensures that you comply with tax laws and maximize any deductions or credits you may be eligible for.

Organizing investment-related documents for tax purposes

Organizing your investment-related documents is key to accurately reporting your investment income on your tax returns. Here are some tips to help you stay organized:

- Keep all statements, receipts, and records related to your investments in one place.

- Create separate folders for different types of investments, such as stocks, bonds, and mutual funds.

- Make sure to include information on any dividends, interest, or capital gains earned from your investments.

- Consider using a digital filing system or software to easily track and access your investment documents.

Calculating and reporting capital gains and losses accurately

Reporting capital gains and losses correctly is essential for determining your tax liability. Here’s how you can calculate and report them accurately:

- Calculate your capital gains by subtracting the purchase price from the sale price of an investment.

- Report short-term capital gains (assets held for one year or less) and long-term capital gains (assets held for more than one year) separately on your tax return.

- Offset your capital gains with any capital losses you may have incurred during the year.

- Include all relevant information on Schedule D of your tax return, including details of each investment, the purchase and sale dates, and the corresponding gains or losses.

- Keep track of any carryover losses from previous years to ensure they are correctly applied to offset current year gains.