Financial literacy resources are like the secret sauce to mastering your money game. Dive into this guide for a fresh take on why knowing your dollars and cents is the key to financial success.

From understanding credit scores to budgeting like a boss, this overview covers the essentials you need to navigate the world of finances like a pro.

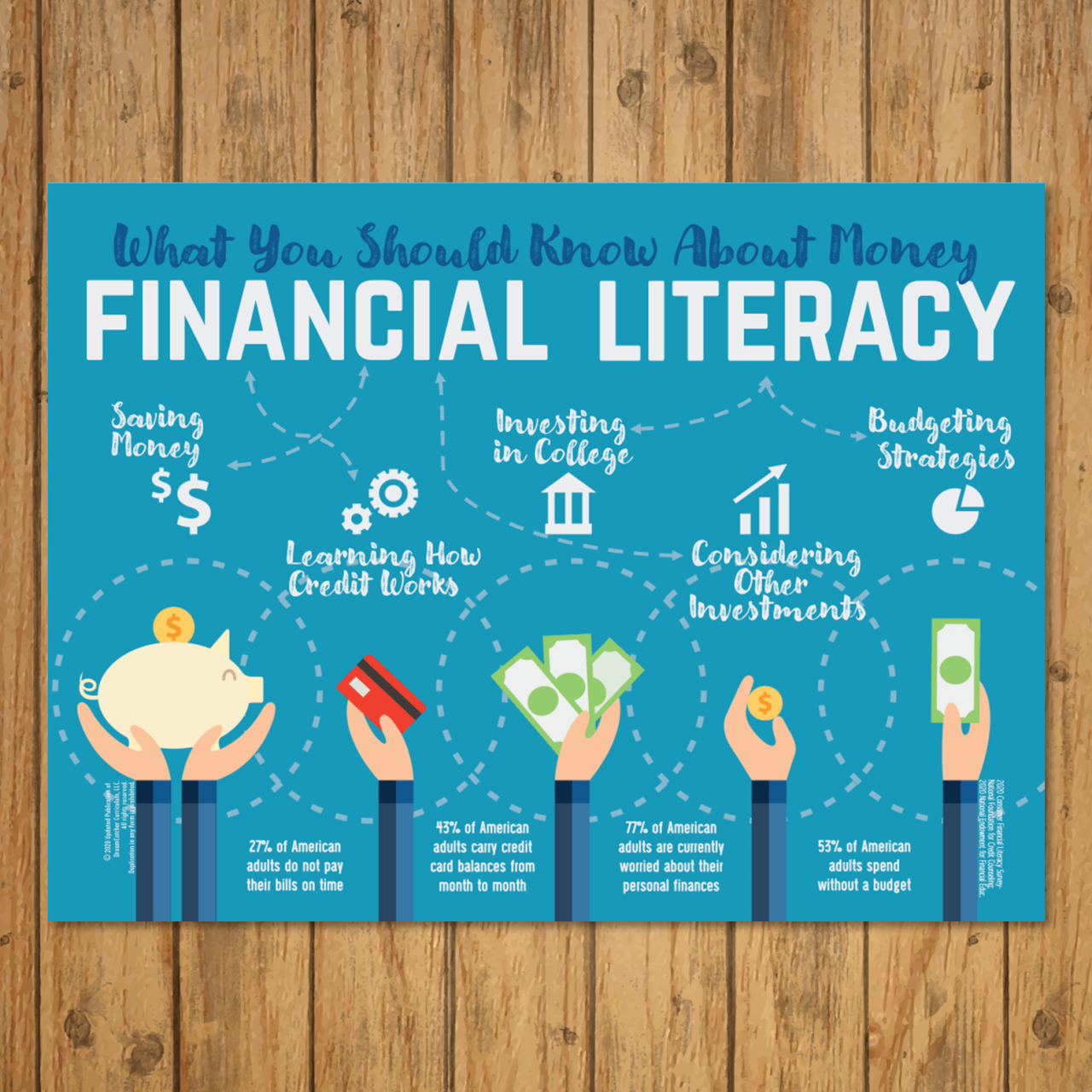

Importance of Financial Literacy

Financial literacy is like the secret sauce to managing your money game like a boss. It’s all about understanding how to make, save, invest, and spend your cash wisely. So why is it so crucial? Let’s break it down.

Financial Stability

Financial literacy can be the key to unlocking personal financial stability. When you know how to budget, save for the future, and avoid debt traps, you’re setting yourself up for success. It’s like having a solid game plan to score big in the money game.

Benefits in Today’s Society

Being financially literate in today’s fast-paced world is like having a superpower. You can make informed decisions about your finances, navigate the complex world of investments, and protect yourself from financial scams. It’s all about being in control and leveling up your financial game.

Key Components of Financial Literacy Resources

Financial literacy resources cover essential topics to help individuals manage their finances effectively. Understanding key components such as budgeting, saving, and credit scores is crucial for financial stability and success.

Budgeting and Saving

Budgeting is a fundamental aspect of financial literacy as it involves creating a plan for how you will spend your money. By outlining your income and expenses, you can track where your money is going and identify areas where you can save. Saving, on the other hand, is setting aside a portion of your income for future needs or emergencies.

Both budgeting and saving are essential for building financial security and achieving your financial goals.

Credit Scores and Reports

Credit scores play a significant role in determining your financial health and eligibility for loans or credit cards. Understanding how credit scores are calculated and how to maintain a good credit score is crucial for accessing favorable interest rates and financial opportunities. Monitoring your credit report regularly can help you detect errors or fraudulent activity that could negatively impact your credit score.

Types of Financial Literacy Resources

Financial literacy resources come in various forms to cater to different learning styles and preferences. Let’s explore the different types of resources available to help individuals improve their financial knowledge and skills.

Online Financial Literacy Courses vs. In-Person Workshops

- Online Financial Literacy Courses:

- Convenient and flexible, allowing learners to access the material at their own pace and schedule.

- Can reach a wider audience, breaking geographical barriers and providing access to individuals in remote areas.

- Often interactive with quizzes, assignments, and forums for discussion with peers and instructors.

- In-Person Workshops:

- Offer a more personalized and hands-on learning experience with direct interaction with instructors and other participants.

- Encourage networking and sharing of experiences among participants, fostering a supportive learning environment.

- Provide immediate feedback and clarification on concepts through face-to-face interactions.

Advantages of Financial Literacy Apps

- Accessibility: Financial literacy apps are available on smartphones and tablets, making learning convenient and portable.

- Engagement: Apps often use gamification and interactive features to keep users motivated and interested in learning financial concepts.

- Tracking Progress: Users can track their financial goals, budgets, and savings through the app, providing a visual representation of their financial health.

Value of Books and Podcasts as Financial Literacy Resources

- Books:

- Provide in-depth knowledge on specific financial topics, offering a comprehensive understanding of concepts.

- Allow for self-paced learning and the ability to revisit chapters for better comprehension.

- Written by experts in the field, offering valuable insights and practical advice.

- Podcasts:

- Offer a convenient way to learn on-the-go, whether commuting, exercising, or doing chores.

- Showcase real-life stories and experiences shared by financial experts and individuals, making the content relatable.

- Provide a variety of perspectives on financial topics, exposing listeners to different strategies and approaches.

Strategies for Teaching Financial Literacy

Teaching financial literacy to children is crucial for their future financial well-being. It is important to incorporate real-life examples in financial education to make concepts more relatable and understandable. Engaging students or individuals in learning financial literacy concepts can be done through interactive activities and practical applications.

Effective Methods for Teaching Financial Literacy to Children

- Use age-appropriate language and examples to explain financial concepts.

- Integrate financial literacy lessons into other subjects to show real-world applications.

- Encourage hands-on learning through activities like budgeting games or savings challenges.

- Provide opportunities for children to earn and manage money, such as through allowance or small jobs.

Importance of Incorporating Real-Life Examples in Financial Education

- Real-life examples help students see the practical implications of financial decisions.

- They make abstract concepts more concrete and easier to grasp.

- By relating financial literacy to everyday situations, students are more likely to retain and apply the knowledge.

- Real-life examples can also motivate students to learn more about personal finance and take control of their financial future.

Tips on Engaging Students in Learning Financial Literacy Concepts

- Use interactive tools and technology to make learning fun and engaging.

- Organize field trips to banks, businesses, or financial institutions to provide real-world exposure.

- Invite guest speakers or experts in finance to share their experiences and insights.

- Encourage group discussions and activities to foster collaboration and critical thinking.

Impact of Financial Literacy on Different Age Groups: Financial Literacy Resources

Financial literacy plays a crucial role in empowering individuals of all ages to make informed financial decisions and secure their financial future. Let’s explore how financial literacy can impact different age groups.

Teenagers and Young Adults

Financial literacy can benefit teenagers and young adults by equipping them with essential money management skills early on in life. By understanding concepts such as budgeting, saving, and investing, young individuals can establish a strong financial foundation for the future.

- Developing healthy financial habits from a young age

- Building a positive credit history

- Creating a financial plan for short and long-term goals

Older Adults

Older adults may face challenges in improving financial literacy due to factors such as retirement planning, healthcare costs, and managing investments. Tailored financial literacy resources can help older adults navigate these complex financial decisions and secure their retirement.

- Understanding retirement savings options

- Managing healthcare expenses effectively

- Protecting against financial scams and fraud

Tailored Financial Literacy Resources

It is essential to provide tailored financial literacy resources for diverse age groups to address their specific needs and challenges. By customizing financial education materials and programs, individuals of all ages can enhance their financial knowledge and make informed decisions that align with their life stages.

- Interactive workshops for teenagers and young adults

- Retirement planning seminars for older adults

- Online resources for all age groups