Dive into the exciting world of day trading strategies where quick decisions and market insights can make or break your success. From common techniques to risk management, this guide covers it all to help you navigate the fast-paced world of day trading with confidence.

Learn how to analyze market conditions, implement strategies effectively, and make informed decisions that can lead to profitable trades.

Common Day Trading Strategies

Day trading is a fast-paced and dynamic way of trading in the financial markets. Traders buy and sell financial instruments within the same trading day to profit from short-term price movements. There are several common day trading strategies that traders use to capitalize on these price fluctuations.

Scalping

Scalping is a popular day trading strategy that involves making numerous small trades throughout the day to profit from small price movements. Traders who use this strategy aim to take advantage of the bid-ask spread and typically hold positions for a very short period, sometimes just seconds or minutes. While individual profits may be small, they can add up over time with a high volume of trades.

Momentum Trading

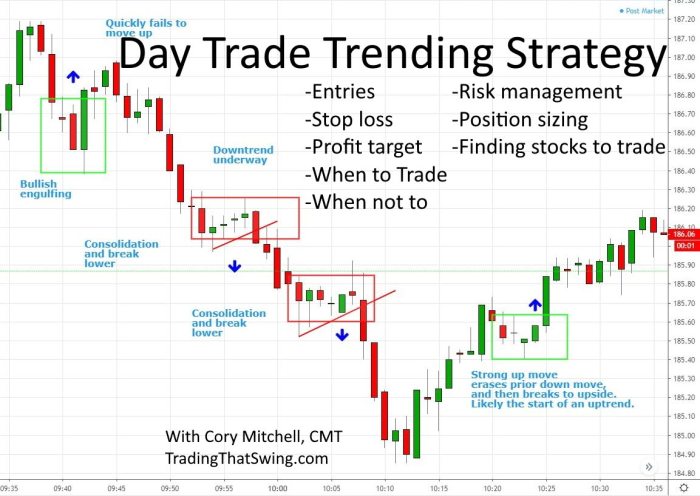

Momentum trading is another common day trading strategy that involves buying securities that are showing strong upward momentum and selling securities that are showing downward momentum. Traders using this strategy believe that the price of a security will continue to move in the same direction as the current trend.

Range Trading

Range trading is a strategy where traders identify levels of support and resistance on a price chart and buy at the lower boundary of the range and sell at the upper boundary. This strategy is based on the belief that prices will remain within a certain range for a period of time before breaking out.

Breakout Trading

Breakout trading involves entering a trade when the price of a security breaks through a significant level of support or resistance with high volume. Traders using this strategy believe that the breakout will lead to a significant price movement in the direction of the breakout.

These are just a few of the common day trading strategies that traders use to navigate the fast-paced world of day trading. Successful implementation of these strategies requires discipline, risk management, and a thorough understanding of the markets.

Technical Analysis in Day Trading

In day trading, technical analysis plays a crucial role in helping traders make informed decisions based on historical price movements and market trends. By analyzing charts and using various technical indicators, traders can identify potential entry and exit points for their trades.

Commonly Used Technical Indicators

- Moving Averages: By calculating the average price of a security over a specific period, moving averages help traders identify trends and potential support or resistance levels.

- RSI (Relative Strength Index): RSI measures the speed and change of price movements, indicating whether a security is overbought or oversold.

- Bollinger Bands: These bands consist of a moving average and two standard deviations, helping traders identify volatility and potential reversal points.

- MACD (Moving Average Convergence Divergence): MACD shows the relationship between two moving averages of a security’s price, signaling potential trend changes.

Identifying Entry and Exit Points

Technical analysis can help traders pinpoint entry and exit points by looking at various indicators and patterns in the market. For example, a trader may use a combination of moving averages and RSI to confirm a trend before entering a trade. Additionally, support and resistance levels identified through technical analysis can act as key areas for setting stop-loss orders and profit targets.

Risk Management Techniques

Day traders use various risk management techniques to protect their capital and minimize losses while maximizing profits. One of the most crucial techniques is setting stop-loss orders in day trading strategies, which help limit losses by automatically selling a security when it reaches a predetermined price level. Additionally, position sizing strategies are essential to manage risk effectively by determining the appropriate amount of capital to allocate to each trade based on the trader’s risk tolerance and overall portfolio size.

Setting Stop-Loss Orders

Stop-loss orders are crucial in day trading as they help prevent emotional decision-making and limit potential losses. By setting a stop-loss order at a specific price level, traders can automatically exit a trade if the price moves against them, protecting their capital from significant losses. This technique is essential for disciplined trading and ensuring that losses are controlled within predetermined limits.

Position Sizing Strategies

Position sizing is a key risk management technique that involves determining the appropriate amount of capital to risk on each trade based on factors such as the trader’s risk tolerance, account size, and the volatility of the security being traded. By sizing positions appropriately, traders can ensure that they do not overexpose themselves to excessive risk and can effectively manage their overall portfolio risk. Common position sizing methods include the fixed percentage method and the fixed dollar method, both of which help traders maintain consistency in their risk management approach.

Planning and Preparation

When it comes to day trading, planning and preparation are key elements for success. By creating a solid trading plan and setting realistic goals, traders can enhance their chances of executing effective strategies and managing risks efficiently.

Creating a Trading Plan

- Artikel specific criteria for entering and exiting trades.

- Establish risk management rules to protect capital.

- Set profit targets to lock in gains.

- Include guidelines for analyzing market conditions and identifying opportunities.

Setting Realistic Goals and Expectations

- Define achievable targets based on your trading style and risk tolerance.

- Avoid aiming for unrealistic profits that could lead to impulsive decisions.

- Understand that losses are part of trading and focus on consistent performance.

- Regularly review and adjust goals to reflect changing market conditions.