Credit Score Improvement is crucial for securing a solid financial future. By understanding the ins and outs of credit scores, you can take proactive steps to enhance your creditworthiness and open doors to better financial opportunities.

Whether you’re aiming for lower loan interest rates, better credit card offers, or simply peace of mind knowing you have a strong financial foundation, improving your credit score is a key step towards achieving your goals.

Importance of Credit Score Improvement

Improving your credit score is crucial for your financial well-being. A good credit score opens up a world of opportunities and benefits that can positively impact various aspects of your life.

Yo, to step up your game in business, you gotta focus on Improving Customer Satisfaction. Keeping your customers happy is key to building a solid reputation and increasing loyalty. By providing top-notch service and listening to their feedback, you can ensure repeat business and attract new customers. It’s all about that customer love, so don’t sleep on it!

Benefits of Having a Good Credit Score

Having a good credit score can lead to lower interest rates on loans, saving you money in the long run. Lenders see you as a less risky borrower, making it easier to qualify for credit cards, mortgages, and other loans.

Yo, if you’re looking to step up your game in the business world, you gotta focus on Improving Customer Satisfaction. Happy customers mean repeat business, word-of-mouth referrals, and a solid reputation. Take the time to listen to their feedback, address their concerns, and go the extra mile to exceed their expectations. That’s how you build a loyal customer base and stand out from the competition.

Keep it real, keep it customer-centric!

- Higher credit limits: A good credit score can result in higher credit limits on your credit cards, giving you more purchasing power.

- Better insurance rates: Insurance companies often use credit scores to determine premiums, so a good credit score can lead to lower rates on auto, home, and other types of insurance.

- Approval for rental applications: Landlords may check your credit score when you apply to rent a home or apartment. A good credit score can increase your chances of getting approved.

Impact of Higher Credit Score on Loan Interest Rates

A higher credit score can result in lower interest rates on loans, saving you thousands of dollars over the life of a loan.

- For example, with a good credit score, you may qualify for a mortgage with a lower interest rate, reducing your monthly payments and overall loan costs.

- Similarly, a high credit score can lead to better rates on auto loans, personal loans, and student loans, making borrowing more affordable.

Understanding Credit Scores: Credit Score Improvement

Credit scores are numerical representations of an individual’s creditworthiness, used by lenders to determine the likelihood of borrowers repaying their debts. These scores are calculated based on various factors related to a person’s credit history and financial behavior.

What Influences Credit Scores

- Payment History: Timely payments on credit accounts contribute positively to credit scores.

- Amounts Owed: The total amount of debt owed, as well as the utilization of available credit, impact scores.

- Length of Credit History: The longer the credit history, the better for the credit score.

- New Credit: Opening multiple new credit accounts in a short period can lower scores.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards and loans, can be beneficial.

FICO vs. VantageScore

FICO and VantageScore are two commonly used credit scoring models. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. VantageScore ranges from 300 to 850 as well, but the way they calculate scores may differ slightly. Both are widely accepted by lenders.

Checking Your Credit Score

- Get a Free Credit Report: AnnualCreditReport.com provides free credit reports from the three major credit bureaus.

- Use Credit Monitoring Services: Websites like Credit Karma or Credit Sesame offer free credit score monitoring services.

- Check with Your Credit Card Issuer: Some credit card companies provide free credit score updates to their customers.

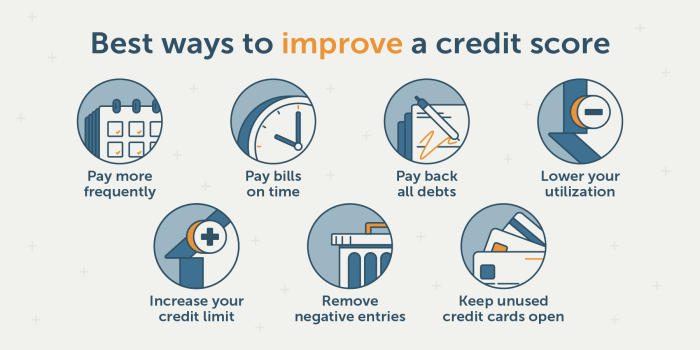

Strategies for Credit Score Improvement

Improving your credit score is essential for financial stability and future opportunities. By implementing smart strategies, you can boost your credit score and open doors to better financial options.

1. Pay Bills on Time

One of the most crucial steps in improving your credit score is to pay your bills on time. Late payments can have a significant negative impact on your credit score, so make sure to prioritize timely payments for all your bills.

2. Monitor Credit Utilization

Credit utilization, or the amount of credit you are using compared to your total available credit, plays a big role in your credit score. Aim to keep your credit utilization below 30% to show lenders that you can manage credit responsibly.

3. Reduce Debt

Reducing your overall debt can also help improve your credit score. Create a plan to pay off outstanding debts, starting with high-interest debts first. By lowering your debt-to-income ratio, you can positively impact your credit score.

Building a Positive Credit History

Building a positive credit history is crucial for financial success and stability. Lenders use your credit history to determine your creditworthiness, which affects your ability to borrow money, get approved for loans, and even secure better interest rates.

The Significance of Good Credit Habits

Establishing and maintaining good credit habits is key to building a positive credit history. This includes making on-time payments, keeping credit card balances low, and avoiding opening multiple new accounts at once. Consistently demonstrating responsible credit behavior will help boost your credit score over time.

The Role of Credit Accounts, Credit Score Improvement

Credit accounts play a significant role in shaping your credit history. These accounts include credit cards, loans, and other lines of credit. By responsibly managing these accounts, you can show lenders that you are a reliable borrower, which can lead to better credit opportunities in the future.

Tips for Diversifying Credit Accounts

Diversifying your credit accounts can help improve your credit profile. Having a mix of credit types, such as credit cards, a mortgage, and a car loan, shows that you can manage different types of credit responsibly. This diversity can demonstrate your ability to handle various financial obligations and can positively impact your credit score.