Budgeting techniques set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Importance of Budgeting Techniques

Budgeting techniques play a crucial role in both personal and business financial management. By creating a budget and sticking to it, individuals and organizations can effectively track their income and expenses, allocate resources wisely, and achieve financial stability.

Financial Stability through Effective Budgeting

- Setting financial goals: Budgeting helps individuals and businesses set clear financial goals and work towards achieving them.

- Control over spending: By monitoring expenses and prioritizing needs over wants, budgeting allows for better control over spending habits.

- Saving for emergencies: Effective budgeting techniques enable the creation of emergency funds, providing a safety net in times of unexpected financial challenges.

- Debt management: Budgeting helps in managing debt by allocating funds towards debt repayment and avoiding accumulating more debt.

Impact of Poor Budgeting Techniques

- Financial stress: Poor budgeting techniques can lead to financial stress due to overspending, inadequate savings, and uncertainty about future financial obligations.

- Increased debt: Without a proper budget in place, individuals and businesses may accumulate debt easily, leading to financial instability and difficulty in meeting financial obligations.

- Lack of financial growth: Failing to budget effectively can hinder financial growth, preventing individuals and businesses from achieving their long-term financial goals.

- Risk of bankruptcy: Continuous poor budgeting practices can eventually result in bankruptcy for businesses and individuals who are unable to manage their finances effectively.

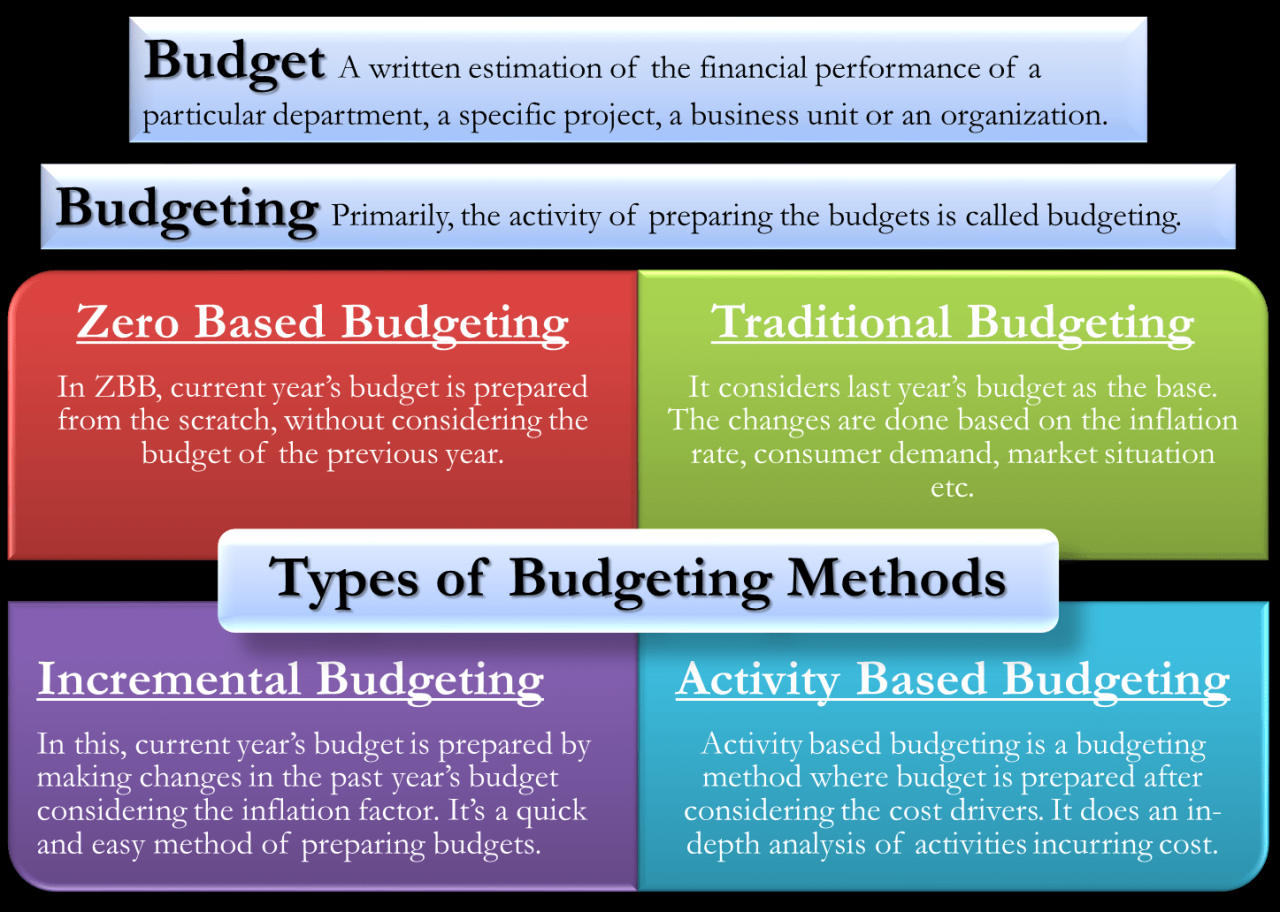

Types of Budgeting Techniques

Budgeting techniques are essential tools for managing finances effectively. Different types of budgeting techniques cater to various financial situations and goals. Let’s explore some of the most common techniques used by individuals and companies.

Zero-Based Budgeting

Zero-based budgeting is a method where every expense must be justified for each new budgeting period. This technique starts from zero and requires all expenses to be approved based on necessity, regardless of previous budgets. It is highly suitable for individuals or companies looking to cut costs and prioritize spending efficiently.

Incremental Budgeting

Incremental budgeting involves making adjustments to the previous budget by adding or subtracting a certain percentage. This technique is useful for situations where past trends can predict future expenses accurately. It is commonly used by organizations with stable financial patterns and steady growth.

Activity-Based Budgeting

Activity-based budgeting focuses on the costs associated with specific activities or tasks within an organization. By allocating resources based on the activities that consume them, companies can optimize their budgeting process and improve cost management. This technique is beneficial for businesses with diverse operations and complex cost structures.

Flexible Budgeting

Flexible budgeting adjusts the budget based on changes in activity levels. It allows for variations in expenses and revenues, making it suitable for businesses with fluctuating demand or seasonal sales patterns. By adapting to different circumstances, companies can maintain financial stability and make informed decisions.

Beyond Budgeting

Beyond budgeting is a more holistic approach that focuses on continuous planning and performance evaluation rather than rigid budget constraints. It encourages adaptive strategies and decentralized decision-making, promoting innovation and responsiveness to market dynamics. This technique is ideal for modern businesses seeking agility and long-term sustainability.

Implementing Budgeting Techniques

Implementing budgeting techniques effectively requires careful planning and discipline. It involves following a structured process to ensure your financial goals are met and your expenses are managed efficiently.

Steps to Implementing a Budgeting Technique

When implementing a budgeting technique, consider the following steps:

- Assess Your Current Financial Situation: Start by evaluating your income, expenses, debts, and savings to get a clear picture of where you stand financially.

- Set Realistic Financial Goals: Define clear and achievable financial goals to guide your budgeting process and keep you motivated.

- Choose a Budgeting Technique: Select a budgeting method that aligns with your goals and preferences, whether it’s zero-based budgeting, the 50/30/20 rule, or any other approach.

- Create a Budget: Develop a detailed budget that Artikels your income sources, fixed and variable expenses, savings targets, and debt repayment plan.

- Track Your Spending: Monitor your expenses regularly to ensure you are staying within budget and adjust as needed to meet your financial goals.

- Review and Adjust: Periodically review your budget to identify areas for improvement and make necessary adjustments to optimize your financial management.

Tips for Setting Realistic Financial Goals

Setting realistic financial goals is essential for successful budgeting. Consider the following tips:

- Be Specific: Clearly define your financial objectives, whether it’s saving for a vacation, paying off debt, or building an emergency fund.

- Be Measurable: Set quantifiable targets, such as saving a specific amount each month or reducing expenses by a certain percentage.

- Be Achievable: Ensure your goals are within reach based on your current financial situation and resources.

- Be Relevant: Align your goals with your long-term financial plans and personal priorities to stay motivated and focused.

- Be Time-Bound: Establish deadlines for achieving your financial goals to track progress and maintain accountability.

Common Challenges and How to Overcome Them

Many people face obstacles when trying to implement budgeting techniques. Here are some common challenges and ways to overcome them:

- Lack of Discipline: Stay committed to your budgeting goals by tracking your progress regularly and reminding yourself of the benefits of financial stability.

- Unexpected Expenses: Prepare for unforeseen costs by including a buffer in your budget for emergencies or unexpected events.

- Income Fluctuations: Adjust your budget to accommodate changes in income levels and prioritize essential expenses during lean months.

- Peer Pressure: Resist the temptation to overspend by staying focused on your financial goals and finding alternative ways to socialize without breaking the bank.

- Procrastination: Start budgeting now rather than waiting for the perfect time, and seek support from friends, family, or financial advisors to stay on track.

Tools and Resources for Budgeting

Budgeting tools and software play a crucial role in helping individuals manage their finances effectively. These tools provide insights into spending habits, track expenses, set savings goals, and create budgets. Let’s explore some popular options and compare their features to help you choose the right budgeting tool for your needs.

Popular Budgeting Tools and Apps

- 1. Mint: Mint is a free budgeting app that allows users to link their bank accounts, track spending, set financial goals, and receive alerts for unusual account activity.

- 2. YNAB (You Need A Budget): YNAB is a subscription-based budgeting tool that focuses on giving every dollar a job. It offers budgeting workshops and personalized support to help users stay on track.

- 3. Personal Capital: Personal Capital is more investment-focused but also offers budgeting tools to track expenses, manage debt, and plan for retirement.

Comparing Features of Budgeting Tools

| Features | Mint | YNAB | Personal Capital |

|---|---|---|---|

| Cost | Free | Subscription-based | Free with premium options |

| Goal Setting | Yes | Yes | Yes |

| Investment Tracking | No | No | Yes |

Recommendations for Choosing the Right Budgeting Tool

- – Consider your financial goals: If you are focused on saving and budgeting, YNAB might be the right choice. If you want to track investments as well, Personal Capital could be a better fit.

- – Trial different tools: Many budgeting apps offer free trials, so test out a few to see which interface and features work best for you.

- – Seek user reviews: Look for feedback from current users to understand the pros and cons of each tool before making a decision.