With Budgeting for small businesses at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

Budgeting is like the cool kid in school that everyone wants to hang out with – it’s crucial for small businesses to thrive and succeed. It’s the secret sauce that can make or break a business’s financial health. Get ready to dive into the world of budgeting for small businesses and discover how it can transform your financial game!

Importance of Budgeting

Budgeting is a crucial aspect for small businesses as it provides a roadmap for financial success. By creating and following a budget, small businesses can effectively manage their cash flow, track expenses, and plan for future growth. Without a budget in place, small businesses may encounter financial challenges that can hinder their operations and growth potential.

Impact on Financial Health

- Effective budgeting can help small businesses identify areas where they can cut costs and increase revenue. This can lead to improved profitability and sustainability.

- By setting clear financial goals and monitoring progress through budgeting, small businesses can make informed decisions to allocate resources efficiently.

- Having a budget in place can also help small businesses prepare for unexpected expenses or economic downturns, providing a safety net during tough times.

Consequences of Not Budgeting

- Without a budget, small businesses may overspend on unnecessary expenses, leading to cash flow problems and potential financial instability.

- Not having a budget can make it difficult for small businesses to track their financial performance and make strategic decisions for growth.

- Small businesses that fail to budget may struggle to secure financing or attract investors due to a lack of financial planning and transparency.

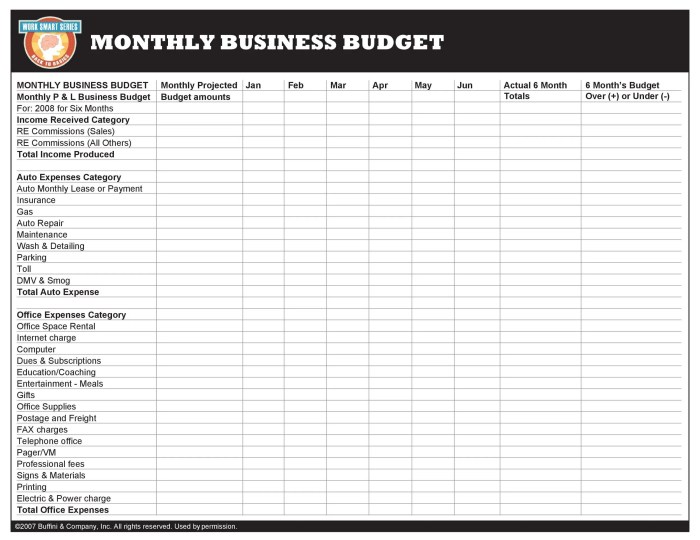

Creating a Budget

Creating a budget for a small business is crucial for financial planning and decision-making. It involves several key steps and considerations to ensure the business stays on track financially.

Step 1: Determine Financial Goals

- Identify short-term and long-term financial objectives for the business.

- Set realistic revenue targets and expense projections based on historical data and market trends.

Step 2: Estimate Income and Expenses

- Forecast sales revenue based on past performance and market analysis.

- List all fixed and variable expenses, including rent, utilities, salaries, and supplies.

Step 3: Choose a Budgeting Method

- Incremental Budgeting: Adjust previous budgets with small changes for the next period.

- Zero-Based Budgeting: Start from scratch, justifying every expense for each budget cycle.

- Activity-Based Budgeting: Allocate funds based on specific activities or projects within the business.

Step 4: Include Key Components in the Budget

- Income Statement: Projected revenue and expenses to determine profitability.

- Balance Sheet: Assets, liabilities, and equity to assess the financial health of the business.

- Cash Flow Statement: Forecast cash inflows and outflows to ensure liquidity.

Monitoring and Adjusting Budgets

Monitoring a budget regularly is crucial for small businesses to ensure financial stability and success. By keeping a close eye on expenses and income, businesses can identify any discrepancies early on and make necessary adjustments to stay on track.

Importance of Regular Monitoring

Regular monitoring of a budget allows small businesses to:

- Track cash flow and identify any potential issues.

- Make informed decisions based on financial data.

- Plan for future expenses and investments.

- Identify areas for cost-cutting or revenue growth.

Strategies for Tracking Expenses and Income

Effective strategies for tracking expenses and income include:

- Maintaining detailed records of all financial transactions.

- Using accounting software to automate the process and generate reports.

- Setting up regular financial reviews to analyze performance.

- Comparing actual expenses and income against budgeted amounts.

Adjusting Budgets When Necessary

Small businesses can adjust their budgets by:

- Identifying areas where expenses exceed projections and finding ways to reduce costs.

- Exploring opportunities to increase revenue through new products or services.

- Revising budget allocations based on changing market conditions or business needs.

- Seeking professional advice from financial experts or consultants.

Tools and Software for Budgeting

When it comes to managing finances for small businesses, having the right tools and software can make a huge difference. Let’s dive into comparing different budgeting tools and software available for small businesses, discussing key features to look for, and sharing some recommendations for free or affordable options.

Comparing Budgeting Tools and Software

- QuickBooks: A popular choice for small businesses, QuickBooks offers features for budgeting, invoicing, and expense tracking.

- FreshBooks: Another user-friendly option, FreshBooks allows for easy budget creation and monitoring.

- Zoho Books: This software integrates budgeting with other financial management tools, providing a comprehensive solution.

- Wave: A free tool that offers budgeting capabilities along with invoicing and receipt scanning.

Key Features to Look for in Budgeting Software

- Customizable budget templates to fit the specific needs of your business.

- Expense tracking features to monitor spending and stay within budget limits.

- Integration with other financial tools like accounting software and payroll services.

- Forecasting capabilities to help plan for future expenses and revenue.

Recommendations for Free or Affordable Budgeting Tools

- Mint: A free personal finance tool that can be adapted for small business use with budgeting features.

- BudgetPulse: A simple budgeting tool that allows for easy tracking of income and expenses.

- EveryDollar: Dave Ramsey’s budgeting tool that focuses on zero-based budgeting principles.