Budgeting for Entrepreneurs sets the stage for financial success in the business world. From creating budgets to managing cash flow, this guide covers essential strategies for entrepreneurs looking to thrive in their ventures.

Importance of Budgeting for Entrepreneurs

Budgeting is a critical aspect of running a successful business for entrepreneurs as it helps in planning, managing resources effectively, and achieving financial goals. Without a budget in place, entrepreneurs may face financial instability, overspending, and lack of direction in their business operations.

Financial Stability

- Having a budget allows entrepreneurs to track their income and expenses, ensuring financial stability and avoiding cash flow issues.

- It helps in identifying areas where expenses can be reduced and resources can be allocated more efficiently.

Resource Management

- Effective budgeting helps entrepreneurs in allocating resources such as capital, time, and manpower wisely to maximize productivity and profitability.

- It enables entrepreneurs to prioritize investments and make informed decisions based on financial data.

Goal Achievement

- A well-planned budget assists entrepreneurs in setting achievable financial goals and monitoring progress towards those goals.

- It serves as a roadmap for the business, guiding decision-making processes and ensuring long-term sustainability.

Risks of Not Having a Budget

- Entrepreneurs without a budget may overspend, leading to financial strain and potential bankruptcy.

- Lack of budgeting can result in poor financial decision-making, hindering growth opportunities and overall success of the business.

Creating a Budget as an Entrepreneur: Budgeting For Entrepreneurs

When starting a business, one of the most crucial steps is creating a budget to manage your finances effectively. A well-thought-out budget can help you stay on track and make informed decisions to ensure the success of your venture.

Steps Involved in Creating a Budget for a Business

- Assess Your Income and Expenses: Start by calculating your expected revenues and listing all your expenses, including fixed costs like rent and variable costs like supplies.

- Set Financial Goals: Determine what you want to achieve financially and set specific, measurable goals that align with your business objectives.

- Allocate Funds Wisely: Prioritize your spending based on the importance of each expense and allocate funds accordingly to ensure you meet your financial goals.

- Monitor and Adjust: Regularly track your budget, compare it to actual financial results, and make necessary adjustments to stay on target.

Tips on Setting Realistic Financial Goals within a Budget

- Be Specific: Define clear and achievable financial goals that are measurable and time-bound to track your progress effectively.

- Consider Your Business Needs: Tailor your financial goals to address the unique requirements and challenges of your business to ensure relevance and success.

- Seek Expert Advice: Consult with financial advisors or mentors to gain insights and guidance on setting realistic financial goals that align with your business growth.

Common Budgeting Mistakes that Entrepreneurs Should Avoid

- Underestimating Expenses: Failing to account for all possible expenses can lead to budget shortfalls and financial challenges down the line.

- Overestimating Revenue: Setting unrealistic revenue targets can create false expectations and hinder your ability to make informed financial decisions.

- Ignoring Cash Flow: Neglecting to manage cash flow effectively can result in cash shortages and impact your ability to operate smoothly.

Tracking Expenses and Income

Tracking both expenses and income is crucial for entrepreneurs to effectively manage their budgets and make informed business decisions. By keeping a close eye on financial transactions, entrepreneurs can identify areas where they can cut costs, increase revenue, and improve profitability.

Tools and Software for Financial Tracking

- QuickBooks: A popular accounting software that helps entrepreneurs track expenses, income, and taxes all in one place.

- Expensify: An expense management tool that simplifies the process of tracking receipts and categorizing expenses.

- Wave: A free accounting software that offers features for invoicing, expense tracking, and financial reporting.

Strategies for Analyzing Financial Data

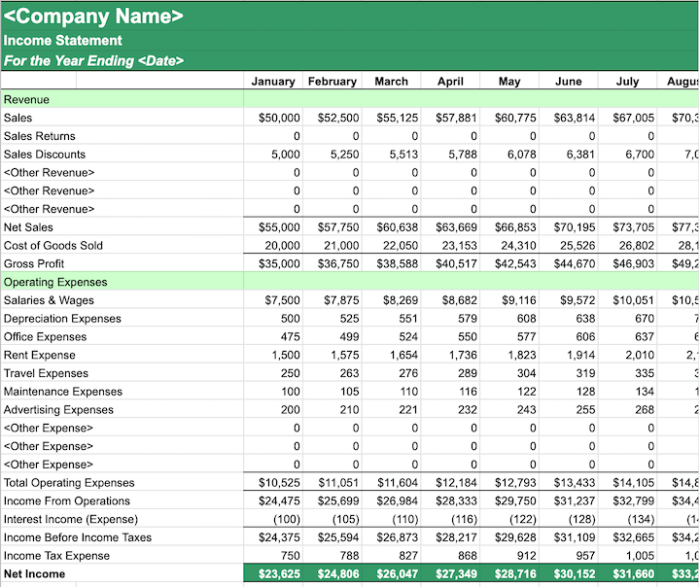

- Regularly review financial statements, such as income statements and balance sheets, to understand the financial health of the business.

- Compare actual financial data to budgeted projections to identify any discrepancies and adjust future financial plans accordingly.

- Use key performance indicators (KPIs) to measure the success of the business and make data-driven decisions to improve performance.

Managing Cash Flow

Cash flow management is crucial for the success of any entrepreneurial venture. It involves monitoring the flow of money in and out of a business to ensure that there is enough cash on hand to cover expenses and invest in growth opportunities. Poor cash flow management can lead to financial instability and even business failure.

Significance of Managing Cash Flow

Effective cash flow management is essential for ensuring the day-to-day operations of a business run smoothly. By keeping a close eye on cash flow, entrepreneurs can anticipate potential cash shortages and take proactive measures to address them. This can help avoid financial crises and keep the business afloat during challenging times.

- Regularly monitor cash flow statements to track incoming and outgoing cash.

- Forecast future cash flow to anticipate any potential gaps in funding.

- Implement strategies to accelerate cash inflows, such as offering discounts for early payments or tightening credit terms.

- Negotiate with suppliers for extended payment terms to improve cash flow.

Optimizing cash flow is like fueling your business engine to keep it running smoothly.

Impact of Poor Cash Flow Management

When cash flow is mismanaged, businesses may struggle to pay bills on time, meet payroll obligations, or invest in growth opportunities. This can result in missed opportunities, damaged relationships with suppliers and employees, and ultimately, business failure. It is crucial for entrepreneurs to prioritize cash flow management to ensure the long-term sustainability of their ventures.

- Delayed payments to suppliers can lead to strained relationships and impact the quality of goods or services received.

- Inadequate cash reserves may hinder the ability to seize opportunities for expansion or innovation.

- Poor cash flow management can damage the business’s reputation and credibility in the market.

Budgeting for Growth and Expansion

When it comes to growing and expanding a business, budgeting plays a crucial role in ensuring that entrepreneurs have the necessary funds to support their goals. By allocating funds strategically and balancing short-term financial needs with long-term growth objectives, entrepreneurs can set themselves up for success.

Allocating Funds for Growth and Expansion, Budgeting for Entrepreneurs

- Set aside a specific portion of your budget for growth initiatives, such as marketing campaigns, product development, or hiring new employees.

- Consider investing in technology or infrastructure upgrades that will support scalability and expansion in the long run.

- Allocate funds for market research and analysis to identify new opportunities and target markets for growth.

Budgeting Strategies for Business Scalability

- Implement zero-based budgeting, where every expense must be justified and approved based on its contribution to growth and expansion.

- Create a rolling budget that allows for flexibility and adjustments as business needs change and new opportunities arise.

- Use benchmarking to compare your budgeting strategies with industry standards and best practices to ensure competitiveness and efficiency.

Balancing Short-term Needs with Long-term Goals

- Focus on maintaining a healthy cash flow to meet short-term financial obligations while still investing in growth opportunities for the future.

- Prioritize investments that will yield long-term benefits, even if it means sacrificing immediate gains or cutting back on certain expenses.

- Regularly review and adjust your budget to align with changing business dynamics and ensure that your growth and expansion plans remain on track.