Benefits of a Roth IRA takes center stage, inviting you into a world of financial wisdom and planning. Get ready to explore the key advantages that can supercharge your retirement savings game.

From tax perks to investment flexibility, this guide will break down everything you need to know about securing a financially stable future with a Roth IRA.

Introduction to Roth IRA

A Roth IRA is a type of retirement account that offers unique benefits compared to a traditional IRA. Unlike a traditional IRA, contributions to a Roth IRA are made with after-tax dollars, meaning withdrawals in retirement are tax-free. This can provide significant advantages for individuals looking to maximize their retirement savings.

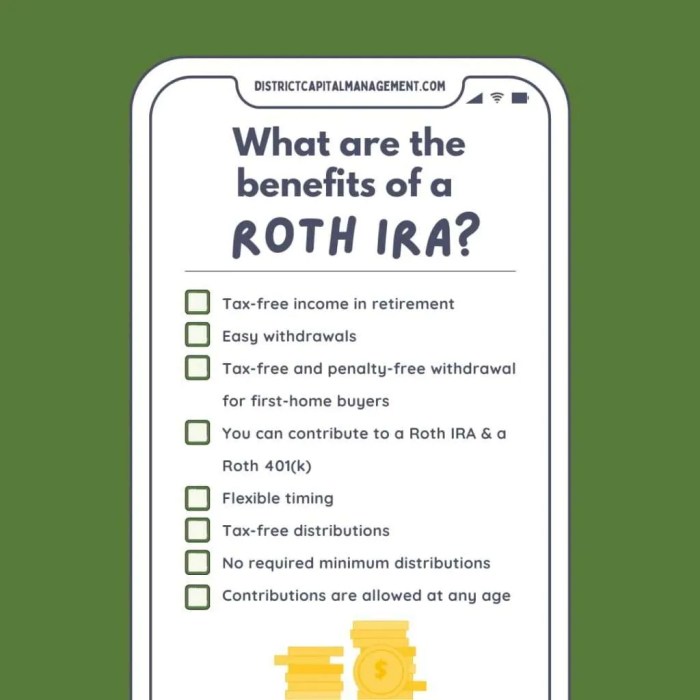

Main Benefits of a Roth IRA

- Tax-Free Withdrawals: One of the key benefits of a Roth IRA is that withdrawals in retirement are tax-free, including both contributions and earnings.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have RMDs, allowing account holders to let their investments grow tax-free for as long as they choose.

- Flexibility in Withdrawals: Contributions to a Roth IRA can be withdrawn at any time without penalty, providing a level of flexibility that other retirement accounts may not offer.

Eligibility Criteria for Opening a Roth IRA

To open a Roth IRA, individuals must meet certain criteria, including:

- Having earned income from employment or self-employment

- Meeting specific income limits based on filing status

- Being under the age of 70 ½

Contribution Limits and Income Restrictions

Contributions to a Roth IRA are subject to annual limits set by the IRS. For 2021, the contribution limit is $6,000 for individuals under 50 and $7,000 for those 50 and older. Additionally, income restrictions apply, with higher earners gradually phasing out their ability to contribute to a Roth IRA.

Tax Advantages of a Roth IRA

When it comes to saving for retirement, a Roth IRA offers unique tax advantages that can benefit you in the long run. Let’s dive into the tax benefits of a Roth IRA:

After-Tax Contributions

Contributions made to a Roth IRA are done with after-tax dollars, meaning you’ve already paid taxes on the money before it goes into your account. This allows your contributions to grow tax-free over time, providing a significant advantage compared to traditional retirement accounts.

Tax-Free Earnings Growth

One of the key benefits of a Roth IRA is that the earnings on your investments grow tax-free. This means you won’t have to pay taxes on any capital gains, dividends, or interest earned within the account. As a result, your money can compound and grow more quickly compared to taxable accounts.

Tax Treatment of Withdrawals

Unlike traditional retirement accounts where withdrawals are taxed as ordinary income, qualified withdrawals from a Roth IRA are tax-free. This means that once you reach retirement age and start withdrawing funds, you won’t owe any taxes on the money you take out, including the earnings.

Tax Diversification in Retirement Planning

Having a Roth IRA in your retirement portfolio provides valuable tax diversification. By having a mix of taxable, tax-deferred, and tax-free accounts, you can strategically manage your tax liabilities in retirement. A Roth IRA gives you the flexibility to control your tax situation and potentially save money on taxes in the long term.

Withdrawal Rules and Penalties: Benefits Of A Roth IRA

When it comes to withdrawing funds from a Roth IRA, there are specific rules and penalties to consider. Understanding these guidelines is crucial to avoid any unexpected fees or consequences.

Penalty-Free Withdrawal Options

- One of the unique features of a Roth IRA is the ability to make penalty-free withdrawals of contributions at any time. This means you can take out the money you initially invested without facing any penalties or taxes.

- For specific situations like a first-time home purchase, you can withdraw up to $10,000 of earnings from your Roth IRA without incurring the usual 10% early withdrawal penalty.

Age Requirements and Required Minimum Distributions

- Individuals can start taking penalty-free withdrawals from a Roth IRA at age 59½, as long as the account has been open for at least five years.

- After reaching age 72, Roth IRA owners are required to take minimum distributions known as Required Minimum Distributions (RMDs) to avoid penalties.

Impact on Taxes and Retirement Income

- Qualified withdrawals from a Roth IRA are tax-free, providing a tax-efficient source of retirement income.

- By strategically planning your Roth IRA withdrawals, you can minimize the tax impact on your overall retirement income and potentially reduce your tax liability in retirement.

Investment Flexibility and Growth Potential

When it comes to a Roth IRA, the investment flexibility and growth potential are key factors that can help you build wealth for the future.Roth IRAs offer a variety of investment options, including stocks, bonds, mutual funds, ETFs, and even real estate. This allows you to create a diversified portfolio tailored to your risk tolerance and financial goals.One of the biggest advantages of a Roth IRA is the potential for tax-free growth and compounding over time.

Unlike a traditional IRA or 401(k), where withdrawals are taxed upon distribution, qualified withdrawals from a Roth IRA are completely tax-free. This means that all the earnings and growth within the account can continue to compound without being eroded by taxes.By taking advantage of the tax-free growth in a Roth IRA, you can maximize your investment returns over the long term.

The power of compounding can significantly boost your savings, especially if you start investing early and contribute consistently over time.For example, let’s say you invest $6,000 per year in a Roth IRA starting at age 25. Assuming an average annual return of 7%, by the time you reach age 65, your account could potentially grow to over $1 million, with all the earnings tax-free.Overall, by strategically diversifying your investments within a Roth IRA and taking advantage of the tax-free growth and compounding, you can harness the full growth potential of your retirement savings.