Small Business Ideas take center stage in this exciting journey, where entrepreneurial minds collide with innovation and passion. From exploring different categories to diving into successful characteristics, this guide is your ticket to entrepreneurial success.

Get ready to unlock the secrets of researching market demand, developing a solid business plan, and securing funding for your next big idea. The world of entrepreneurship awaits – are you ready to make your mark?

Types of Small Business Ideas

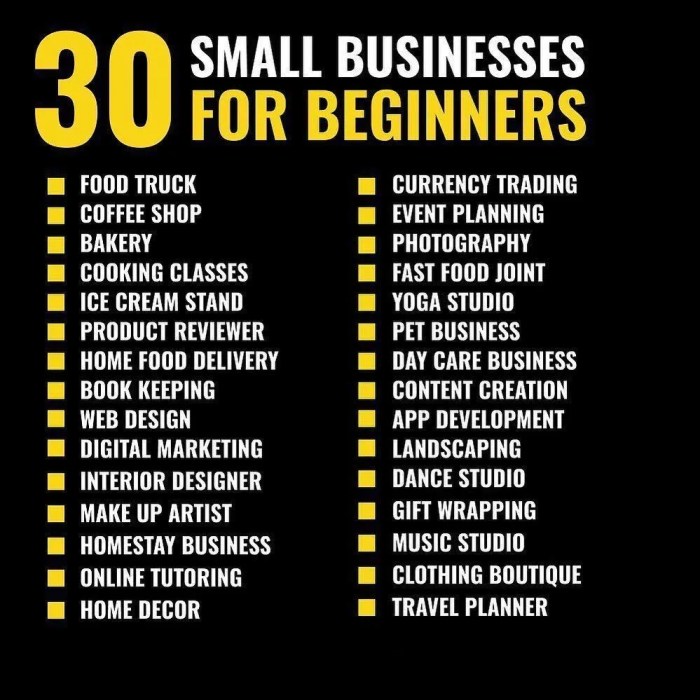

Starting a small business is a big step, but before you dive in, it’s important to consider the type of business you want to pursue. Here are some categories of small business ideas to help you get started.

Service-Based Small Business Ideas

Service-based businesses focus on providing a service to customers rather than selling a physical product. These businesses often require specialized skills and expertise. Examples include consulting, tutoring, event planning, and cleaning services.

Product-Based Small Business Ideas

Product-based businesses involve selling physical products to customers. This can range from handmade goods to manufactured items. Examples include clothing boutiques, artisanal food products, and tech gadgets.

Characteristics of Successful Small Business Ideas

Successful small business ideas share common characteristics that set them apart from the competition. These include:

- Unique Value Proposition: A successful business idea offers something different or better than what is already available in the market.

- Market Demand: There is a clear need or demand for the product or service being offered.

- Scalability: The business has the potential to grow and expand over time.

- Financial Viability: The idea is financially sustainable and has the potential to generate profit.

Service-Based vs. Product-Based Small Business Ideas

When deciding between a service-based or product-based business, it’s important to consider the pros and cons of each. Service-based businesses often require lower startup costs and can be easier to scale, while product-based businesses may offer higher profit margins but require more upfront investment in inventory and production.

Researching Small Business Ideas

When it comes to finding the perfect small business idea, research is key. By understanding market demand, conducting a SWOT analysis, and identifying niche opportunities, you can set yourself up for success in the business world.

Market Demand Research

Researching market demand is crucial for the success of any small business idea. Here are some methods to help you gauge market demand:

- Conduct surveys and polls to gather feedback from potential customers.

- Analyze industry trends and competitor offerings to identify gaps in the market.

- Utilize online tools and resources to track s and search volume related to your business idea.

SWOT Analysis

Performing a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) can help you assess the viability of your small business idea. Here’s how to conduct a SWOT analysis:

- Identify the strengths of your business idea, such as unique selling points or competitive advantages.

- Evaluate potential weaknesses that could hinder the success of your business idea, such as lack of resources or expertise.

- Explore opportunities in the market that your business idea can capitalize on, such as emerging trends or untapped customer segments.

- Recognize potential threats that could pose challenges to your business idea, such as strong competitors or economic downturns.

Identifying Niche Opportunities

Finding a niche market can give your small business idea a competitive edge. Here’s how to identify niche opportunities:

- Research specific customer needs and preferences that are not currently being met by existing businesses.

- Explore underserved or overlooked market segments that have potential for growth.

- Consider specialized products or services that cater to a specific group of customers with unique requirements.

Developing a Business Plan for Small Business Ideas

Starting a small business requires careful planning and organization. A well-thought-out business plan is essential for guiding the growth and success of your small business idea. Here, we will discuss the key components of a business plan, strategies for setting achievable goals, and the importance of financial forecasting.

Essential Components of a Business Plan

A business plan should include the following essential components:

- An executive summary outlining the business concept, goals, and strategies.

- A description of the business, including the products or services offered and the target market.

- Market research and analysis to understand the industry, competition, and target customers.

- An organizational structure detailing the management team and roles within the business.

- A marketing and sales strategy to attract and retain customers.

- A financial plan with revenue projections, budgeting, and funding requirements.

- Risk assessment and contingency plans to address potential challenges.

Setting Achievable Goals

Setting achievable goals is crucial for guiding the growth and development of your small business. Strategies for setting achievable goals include:

- Setting specific, measurable, attainable, relevant, and time-bound (SMART) goals.

- Breaking down larger goals into smaller milestones to track progress.

- Aligning goals with the overall vision and mission of the business.

- Evaluating and adjusting goals based on market changes and business performance.

Importance of Financial Forecasting

Financial forecasting plays a vital role in a small business idea’s business plan by:

- Estimating future revenue, expenses, and cash flow to make informed business decisions.

- Identifying potential financial risks and opportunities for growth.

- Securing funding from investors or lenders by demonstrating a clear financial roadmap.

- Monitoring financial performance and comparing actual results to forecasted numbers.

Funding Small Business Ideas

When it comes to funding small business ideas, entrepreneurs have several options to consider. Whether it’s bootstrapping with personal funds or seeking external funding from investors, each approach has its own set of pros and cons. Additionally, creating a convincing pitch deck is crucial for attracting potential investors and securing the necessary funding for your small business idea.

Bootstrapping vs. External Funding

Bootstrapping, or self-funding, involves using your own savings or revenue generated by the business to finance its operations and growth. On the other hand, seeking external funding means obtaining capital from investors, banks, or other sources outside of your personal finances.

- Bootstrapping: Pros include maintaining full control over the business, avoiding debt, and retaining all profits. However, it may limit the speed of growth and expansion due to limited resources.

- External Funding: Pros include access to larger amounts of capital, expertise from investors, and the potential for rapid growth. However, it may result in giving up equity or control of the business.

Creating a Pitch Deck

A pitch deck is a presentation that Artikels the key aspects of your business idea and why it is a viable investment opportunity. Here are some tips for creating a convincing pitch deck:

- Clear Problem Statement: Clearly define the problem your business idea solves and why it is significant.

- Solution Overview: Present your innovative solution and how it addresses the identified problem effectively.

- Market Opportunity: Highlight the market size, potential for growth, and your target audience.

- Business Model: Explain how your business will generate revenue and sustain profitability.

- Team Introduction: Showcase the qualifications and expertise of your team members.

- Financial Projections: Provide realistic financial projections to demonstrate the potential return on investment.