Diving into the realm of Retirement age statistics, we embark on a journey that delves deep into the numbers, trends, and policies surrounding retirement ages worldwide. Get ready to uncover intriguing insights and fascinating facts that shed light on this crucial aspect of life planning.

Overview of Retirement Age Statistics

Retirement age statistics refer to the data and trends regarding the age at which individuals typically stop working and begin receiving retirement benefits. This information is crucial for policymakers, employers, and individuals planning for their financial future.

Global Retirement Age Variations

Different countries have varying retirement ages based on their social security systems, economic conditions, and cultural norms. For example, in the United States, the full retirement age for Social Security benefits is around 66 to 67 years old. In contrast, countries like France have an official retirement age of 62, while some Nordic countries have higher retirement ages closer to 70.

Evolution of Retirement Age Trends

Over the years, retirement age trends have shifted due to factors such as increased life expectancy, changes in pension systems, and economic conditions. Many countries are raising their retirement ages to address the challenges of an aging population and ensure the sustainability of pension programs. This trend reflects the need for individuals to work longer to support themselves financially in retirement.

Factors Influencing Retirement Age

When it comes to retirement age, there are various factors that influence when individuals decide to retire. These factors can vary based on personal preferences, societal norms, economic conditions, and more. Let’s explore some of the key factors that play a role in determining retirement age.

Gender

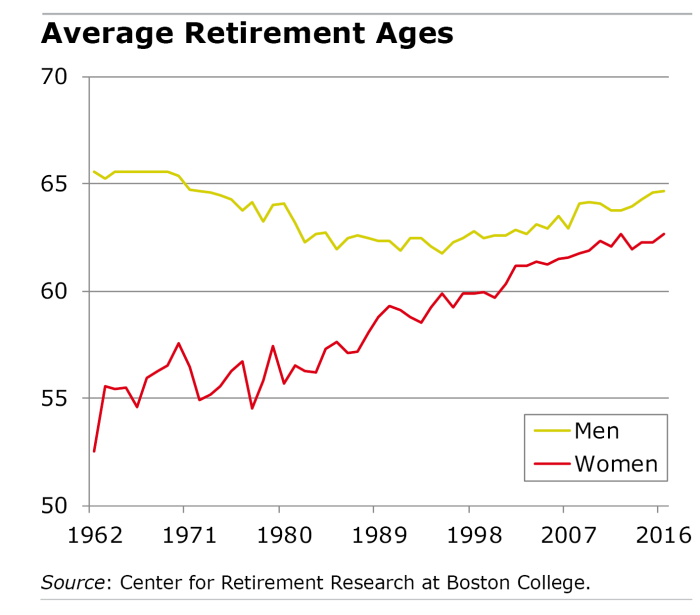

Gender can have a significant impact on retirement age. In many countries, women tend to retire earlier than men due to factors such as caregiving responsibilities, lower lifetime earnings, and longer life expectancy. On the other hand, men may retire later due to societal expectations or the desire to continue working.

Profession

The type of profession an individual is in can also influence their retirement age. For example, individuals in physically demanding jobs may choose to retire earlier to preserve their health and well-being. On the other hand, those in high-paying or fulfilling careers may choose to work longer to continue enjoying their work or to increase their retirement savings.

Country

Retirement age can vary significantly from country to country due to differences in social security systems, healthcare access, and cultural norms. For instance, some countries have mandatory retirement ages while others allow individuals to work well into their later years. Economic conditions and government policies also play a role in determining retirement age across different nations.

Economic Conditions

Economic conditions, such as the state of the economy, inflation rates, and job market stability, can heavily impact retirement age decisions. During times of economic downturn, individuals may be forced to delay retirement due to financial concerns or the need to continue working to make ends meet. On the other hand, a strong economy may provide individuals with the financial security to retire earlier and enjoy their golden years.

Retirement Age Policies

Retirement age policies vary across different countries, impacting the workforce and overall economy.

Different Retirement Age Policies

- In the United States, the full retirement age for Social Security benefits is currently 67, but individuals can start receiving reduced benefits as early as age 62.

- In France, the legal retirement age is 62, but there are plans to gradually increase it to 67 by 2022.

- In Japan, the retirement age is typically set at 60, but many companies have their own policies that allow employees to work until age 65 or older.

Effectiveness of Flexible Retirement Age Policies

Flexible retirement age policies can benefit both employees and employers by allowing individuals to choose when to retire based on their personal circumstances.

Flexible retirement policies can help address issues like labor shortages, skill gaps, and aging populations.

Implications of Increasing or Decreasing Retirement Age Limits

- Increasing retirement age limits can help sustain social security systems and support a growing elderly population.

- However, decreasing retirement age limits may allow younger generations to enter the workforce earlier, potentially reducing unemployment rates.

- Both scenarios have economic and social implications that must be carefully considered by policymakers.

Retirement Age Trends

In recent years, retirement age trends have been shifting globally due to various factors influencing individuals’ decisions on when to retire. One of the key factors impacting retirement age trends is the increase in life expectancy across the world.

Higher life expectancy rates have led to individuals reevaluating their retirement plans and opting to work for longer periods. As people are living longer and healthier lives, they are choosing to extend their careers and delay retirement to ensure financial security in their later years.

Shift Towards Later Retirement Ages

- Many modern societies are witnessing a gradual shift towards later retirement ages, with individuals choosing to work beyond the traditional retirement age of 65.

- This trend is influenced by factors such as inadequate retirement savings, increasing healthcare costs, and the desire to remain active and engaged in the workforce.

- Government policies and pension reforms in some countries have also incentivized individuals to delay retirement by offering benefits for working longer.