Ready to dive into the world of investing in healthcare stocks? Buckle up and get ready for a wild ride as we explore the ins and outs of this exciting sector with a unique American high school hip style twist that will keep you on the edge of your seat.

In this guide, we will break down everything you need to know about healthcare stocks, from understanding the basics to exploring the risks and rewards of this dynamic industry.

Understanding Healthcare Stocks

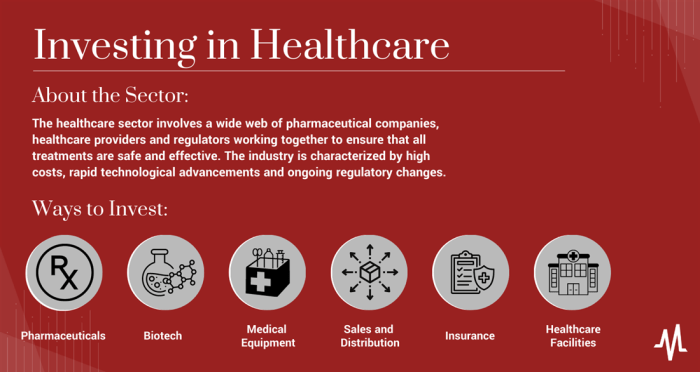

Healthcare stocks are shares of companies that operate within the healthcare industry. These companies can be involved in various aspects of healthcare, such as pharmaceuticals, biotechnology, medical devices, hospitals, and health insurance.

How Healthcare Stocks Differ

Unlike other types of stocks, healthcare stocks are heavily influenced by regulatory decisions, drug approvals, clinical trial results, and healthcare policy changes. The healthcare sector is also known for its defensive nature, as demand for healthcare products and services tends to remain stable even during economic downturns.

Factors Influencing Performance

- Regulatory Environment: Changes in regulations, such as drug pricing policies or healthcare legislation, can significantly impact healthcare stocks.

- Research and Development: Success in developing new drugs or medical technologies can drive stock performance.

- Competitive Landscape: Competition from other companies within the healthcare sector can affect stock prices.

- Global Health Trends: Demographic shifts, disease outbreaks, and healthcare spending trends can influence the performance of healthcare stocks.

Key Players in Healthcare Industry

- Pharmaceutical Companies: Large pharmaceutical companies like Pfizer, Johnson & Johnson, and Merck play a crucial role in the healthcare sector.

- Biotechnology Companies: Biotech firms such as Amgen, Gilead Sciences, and Biogen are known for their innovative drug development.

- Health Insurance Providers: Companies like UnitedHealth Group and Anthem manage health insurance plans that impact healthcare stock prices.

Benefits of Investing in Healthcare Stocks

Investing in healthcare stocks can offer numerous advantages for investors looking to diversify their portfolio and potentially earn significant returns. The healthcare sector is known for its stability, growth potential, and resilience even during economic downturns. Let’s explore some key benefits of investing in healthcare stocks.

Potential Advantages of Healthcare Stock Investments

- Stability and Resilience: Healthcare stocks are considered defensive investments due to the constant demand for healthcare services regardless of economic conditions. This stability can help cushion a portfolio during market volatility.

- Growth Opportunities: The healthcare industry is constantly evolving with advancements in technology, research, and treatments. Investing in innovative healthcare companies can provide significant growth potential.

- Diversification: Including healthcare stocks in a diversified investment portfolio can help spread risk across different sectors, reducing overall volatility.

Examples of Successful Healthcare Stock Investments

- Johnson & Johnson (JNJ): A well-known healthcare company that has consistently delivered strong returns to investors over the years.

- UnitedHealth Group (UNH): One of the largest healthcare providers in the U.S., known for its solid financial performance and steady growth.

Contribution to a Diversified Portfolio

Healthcare stocks can play a crucial role in diversifying an investment portfolio by offering exposure to a sector with unique characteristics and growth prospects. By adding healthcare stocks to a mix of investments from various sectors, investors can potentially reduce risk and enhance overall returns.

Risks Associated with Healthcare Stock Investments

Investing in healthcare stocks comes with its own set of risks that investors need to be aware of. These risks can impact the performance of healthcare stocks and potentially lead to financial losses. One major risk factor is the regulatory environment and healthcare policies that can directly influence the stock prices of healthcare companies.

Regulatory Changes and Healthcare Policies

Regulatory changes in the healthcare industry can greatly impact healthcare stock investments. For example, a new government policy that limits drug pricing or changes in reimbursement rates for healthcare services can significantly affect the profitability of healthcare companies. Investors need to closely monitor any regulatory updates and understand how they can impact the healthcare sector.

External Factors

In addition to regulatory changes, external factors such as economic conditions, technological advancements, and even public health crises can pose risks to healthcare stock investments. For instance, a global pandemic like COVID-19 can disrupt healthcare supply chains, reduce demand for certain medical products, and lead to a decline in healthcare stock prices. Investors should consider these external factors when evaluating the risk associated with healthcare stocks.

Strategies for Investing in Healthcare Stocks

Investing in healthcare stocks can be a lucrative opportunity for investors looking to diversify their portfolios and capitalize on the growth potential of the healthcare industry. However, it is essential to have a solid strategy in place to navigate the complexities of this sector and make informed investment decisions.

When it comes to investing in healthcare stocks, there are different approaches that investors can take, each with its own set of risks and rewards. Two common strategies include growth investing and value investing. Growth investing focuses on investing in healthcare companies that are expected to experience rapid earnings growth in the future, while value investing involves buying healthcare stocks that are currently undervalued by the market.

Regardless of the strategy chosen, conducting thorough research is crucial before investing in healthcare stocks. This includes analyzing the financial statements and performance metrics of healthcare companies to assess their financial health and growth prospects. Investors should pay attention to key metrics such as revenue growth, earnings per share, profit margins, and debt levels to make informed investment decisions.

Analyzing Financial Statements and Performance Metrics

- When analyzing financial statements, investors should look at revenue trends, profitability ratios, and cash flow metrics to understand the financial health of healthcare companies.

- Profit margins, such as gross margin and operating margin, can provide insights into a company’s efficiency and profitability.

- Debt levels and leverage ratios, such as debt-to-equity ratio, can indicate how much debt a healthcare company is using to finance its operations.

- Performance metrics like return on equity (ROE) and return on assets (ROA) can help investors evaluate how effectively a healthcare company is generating profits from its assets.

Emerging Trends in Healthcare Stock Investments

The healthcare industry is constantly evolving, and staying ahead of emerging trends is crucial for successful stock investments. Let’s dive into some of the current trends shaping the healthcare sector and their impact on healthcare stocks.

Rise of Telemedicine

Telemedicine has seen a significant surge in popularity, especially in light of the COVID-19 pandemic. Companies offering telehealth services are attracting investor interest due to the convenience and efficiency they provide in delivering healthcare remotely. This trend is expected to continue growing as more patients opt for virtual consultations and treatments.

Focus on Personalized Medicine

Personalized medicine, which involves tailoring treatments to individual patients based on their genetic makeup, is gaining momentum. Investors are looking at companies that specialize in precision medicine and genetic testing, as these technologies have the potential to revolutionize healthcare outcomes. The demand for personalized healthcare solutions is driving investment in this area.

Expansion of Artificial Intelligence in Healthcare

Artificial intelligence (AI) is being increasingly integrated into various healthcare processes, from diagnostics to patient care. Companies developing AI-driven solutions are attracting investors who see the potential for improved efficiency and accuracy in healthcare delivery. The use of AI in healthcare is expected to grow, creating opportunities for investors in this innovative field.

Investment in Biotech Innovations

Biotechnology companies are at the forefront of developing groundbreaking treatments and therapies for various diseases. Investors are keen on biotech innovations that have the potential to disrupt the healthcare industry and address unmet medical needs. The focus on research and development in biotech is driving investment in companies working on cutting-edge therapies.

Shift Towards Value-Based Care

The shift towards value-based care, which emphasizes quality outcomes over quantity of services provided, is influencing healthcare investments. Companies that can demonstrate improved patient outcomes and cost-effectiveness are attracting investor attention. The emphasis on value-based care is reshaping the healthcare landscape and presenting opportunities for investors to support transformative healthcare models.