Capital appreciation strategies set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Dive into the world of investment portfolios and discover the key to unlocking success through strategic growth.

As we explore the various types of strategies, factors influencing capital appreciation, and the importance of risk management, you’ll gain a deeper understanding of how to make your investments work for you.

Introduction to Capital Appreciation Strategies

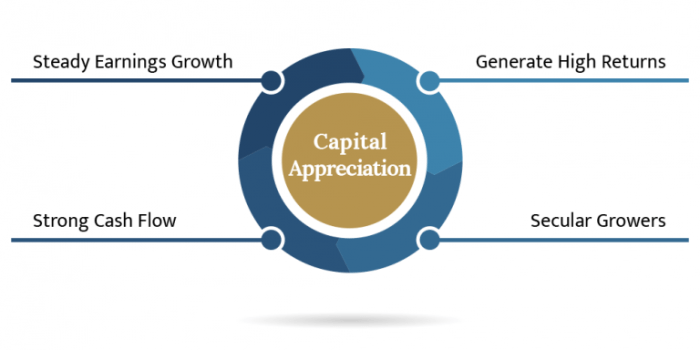

Capital appreciation strategies refer to investment techniques aimed at increasing the value of an asset over time. These strategies are crucial in building wealth and achieving financial goals.

Importance of Capital Appreciation Strategies

- Capital appreciation strategies help investors grow their investment portfolios by increasing the value of their assets.

- These strategies can provide higher returns compared to income-generating investments like bonds or dividend-paying stocks.

- By focusing on assets with growth potential, investors can benefit from capital gains when the asset’s value appreciates.

Assets with Capital Appreciation Potential

- Stocks: Investing in growth stocks of companies with strong potential for future earnings growth can lead to capital appreciation.

- Real Estate: Properties in high-demand areas or those undergoing development can experience significant value appreciation over time.

- Commodities: Certain commodities like gold, silver, and oil can see price increases due to supply and demand dynamics, leading to capital gains for investors.

Types of Capital Appreciation Strategies

When it comes to capital appreciation strategies, there are a couple of key approaches that investors can take to grow their wealth in the stock market. Two common types of strategies include growth investing and value investing.

Growth Investing

Growth investing is a strategy where investors focus on buying stocks of companies that are expected to grow at an above-average rate compared to the market. These companies typically reinvest their earnings into expanding their business, which can lead to higher stock prices. Growth investors often look for companies in innovative industries with high growth potential, such as technology or healthcare. One example of successful growth investing is investing in companies like Amazon or Tesla, which have shown significant growth over the years.

Value Investing

On the other hand, value investing involves buying stocks that are currently undervalued by the market. Value investors believe that the market has not accurately priced the stock and that there is potential for it to increase in value over time. These investors typically look for companies with strong fundamentals, such as a low price-to-earnings ratio or high dividend yield. A classic example of value investing is Warren Buffett’s approach to investing in companies like Coca-Cola or American Express, which were undervalued at the time of purchase but eventually saw their stock prices increase.

Factors Influencing Capital Appreciation

When it comes to capital appreciation strategies, several key factors play a crucial role in determining their success. Understanding these factors is essential for investors looking to maximize their returns and make informed decisions. Let’s dive into the main influencers of capital appreciation.

Economic Conditions Impact

Economic conditions have a significant impact on capital appreciation strategies. During times of economic growth and stability, investors are more likely to see higher returns on their investments. On the other hand, during economic downturns or recessions, the value of assets may decrease, leading to lower capital appreciation. Factors such as interest rates, inflation, GDP growth, and employment levels all influence economic conditions and, in turn, affect the success of capital appreciation strategies.

Market Trends Effect

Market trends also play a crucial role in determining the success of capital appreciation strategies. Investors need to stay informed about market trends, such as industry performance, consumer behavior, and global events, to make strategic investment decisions. A thorough analysis of market trends can help investors identify opportunities for capital appreciation and adjust their strategies accordingly. Whether it’s a bull market or a bear market, understanding market trends is essential for maximizing returns and mitigating risks in capital appreciation.

Risk Management in Capital Appreciation Strategies

When it comes to capital appreciation strategies, risk management plays a crucial role in determining the success of investments. By implementing effective risk management techniques, investors can minimize potential losses and maximize returns. Let’s explore the various ways in which risk is managed in the pursuit of capital appreciation.

Diversification

Diversification is a key risk management technique used in capital appreciation strategies. By spreading investments across different asset classes, industries, and geographical regions, investors can reduce the impact of any single investment underperforming. This helps to mitigate risk and protect the overall portfolio from significant losses. For example, an investor may choose to invest in a mix of stocks, bonds, and real estate to diversify their risk exposure.

Stop-Loss Orders

Another common risk management strategy is the use of stop-loss orders. This technique involves setting predetermined price levels at which an investor will sell a security to limit losses. By implementing stop-loss orders, investors can protect their capital and prevent emotional decision-making during market fluctuations. For instance, an investor may set a stop-loss order at 10% below the purchase price of a stock to automatically sell the stock if it reaches that point.

Risk Assessment and Monitoring

Investors also assess and monitor risks continuously to make informed decisions. This involves conducting thorough research, analyzing market trends, and staying updated on economic indicators. By staying informed and proactive, investors can identify potential risks early on and take necessary actions to mitigate them. For example, an investor may closely monitor interest rates and inflation rates to anticipate how they may impact their investments.

Hedging

Hedging is another risk management strategy that investors use to protect their portfolios from adverse market movements. This involves taking offsetting positions to minimize potential losses. For instance, an investor may use options or futures contracts to hedge against a decline in the value of their stock holdings. By hedging, investors can safeguard their investments against unexpected events and market volatility.