Diving into the realm of global investment trends, we uncover the ever-evolving landscape of financial markets and the influential factors that shape the trends. From geopolitical events to emerging sectors, this overview sets the stage for a thrilling exploration of the world of investments.

Global Investment Trends Overview

In today’s global economy, investment trends are constantly evolving and shaping the financial landscape. Factors such as technological advancements, economic policies, and geopolitical events play a crucial role in influencing where investors choose to allocate their resources. The impact of these trends can be felt across various sectors and industries, driving opportunities and challenges for businesses and individuals alike.

Key Factors Influencing Global Investment Patterns

- Rapid Technological Innovation: The rise of technologies such as artificial intelligence, blockchain, and renewable energy is reshaping industries and creating new investment opportunities.

- Economic Policies: Government regulations, interest rates, and trade agreements can significantly impact investment decisions and market dynamics.

- Market Volatility: Uncertainties in the global market, such as fluctuations in commodity prices or currency values, can influence investor confidence and risk tolerance.

- Demographic Shifts: Changing population trends and consumer behaviors can drive investment trends in areas such as healthcare, real estate, and consumer goods.

Impact of Geopolitical Events on Global Investment Trends

Geopolitical events, such as trade disputes, political unrest, and global conflicts, can create uncertainty and volatility in financial markets, leading investors to reassess their risk exposure and investment strategies.

- Trade Wars: Tariffs and trade tensions between major economies can disrupt supply chains, impact corporate earnings, and alter global trade patterns.

- Political Stability: Political instability in key regions can deter foreign investment and hamper economic growth, affecting investor confidence.

- Global Health Crises: Events like pandemics or health emergencies can have widespread economic repercussions, influencing investment decisions in sectors like healthcare, pharmaceuticals, and travel.

Regional Investment Disparities

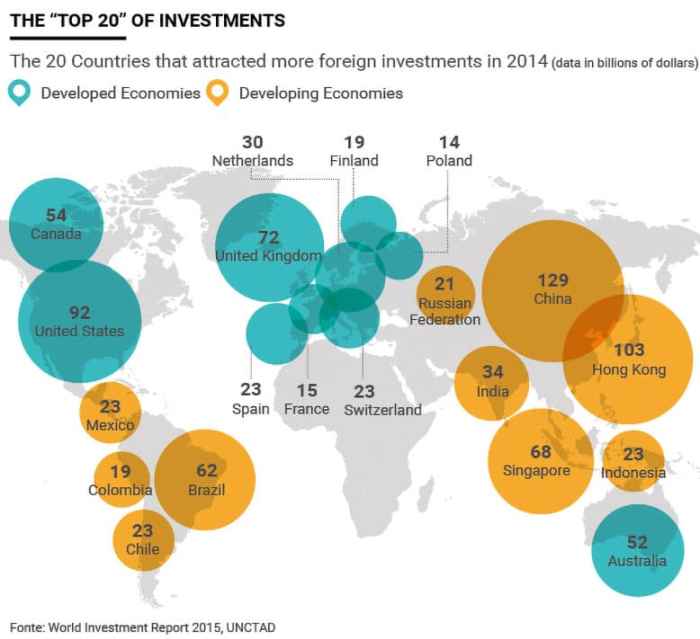

Investment trends vary significantly across different regions, with each region experiencing its own unique opportunities and challenges. Factors such as economic stability, political climate, and market openness play a crucial role in attracting foreign investment.

Asia

Asia has been a hotspot for foreign investment in recent years, with countries like China, India, and Singapore leading the way. China, in particular, has seen a surge in foreign direct investment due to its large market size and rapid economic growth. On the other hand, countries like Vietnam and Indonesia are also emerging as attractive investment destinations, thanks to their growing consumer markets and favorable business environments.

Europe

Europe remains a popular destination for foreign investment, with countries like Germany, the United Kingdom, and France attracting significant capital inflows. The European Union’s single market and stable regulatory environment make it an appealing choice for investors looking to expand their presence in the region. However, political uncertainties, such as Brexit, have posed challenges for investment in certain European countries.

North America

North America, particularly the United States and Canada, continues to be a key destination for foreign investment. The U.S. market’s size and innovation-driven economy make it an attractive choice for investors seeking high returns. Canada, on the other hand, offers a stable political environment and access to the North American market. However, trade tensions and protectionist policies have impacted investment flows in the region.

Emerging Investment Sectors

In today’s rapidly evolving global market, new investment sectors are constantly emerging, presenting both exciting opportunities and potential risks for investors. These sectors are driven by various factors such as technological advancements, changing consumer preferences, and regulatory developments.

Renewable Energy

Renewable energy has been gaining significant traction as a key investment sector due to the growing focus on sustainability and the shift towards clean energy sources. This sector includes investments in solar, wind, hydroelectric, and other renewable energy sources. The potential for long-term growth in renewable energy is driven by government incentives, technological advancements, and increasing awareness of climate change.

Artificial Intelligence

Artificial Intelligence (AI) is another rapidly growing investment sector, driven by advancements in machine learning, data analytics, and automation. AI has applications in various industries such as healthcare, finance, and e-commerce, creating opportunities for investors to capitalize on the potential of AI-driven technologies. However, risks such as data privacy concerns and regulatory challenges need to be carefully considered.

E-Commerce and Digital Payments

The rise of e-commerce and digital payments has transformed the way consumers shop and conduct transactions, leading to significant investment opportunities in this sector. Companies that provide online retail platforms, digital payment solutions, and logistics services have seen substantial growth in recent years. The increasing shift towards online shopping and cashless transactions has fueled the growth of this sector globally.

Healthcare Technology

Healthcare technology is another emerging investment sector driven by the increasing demand for innovative healthcare solutions and digital health platforms. Investments in telemedicine, health monitoring devices, and electronic health records systems have gained momentum as the healthcare industry embraces technology to improve patient care and operational efficiency. The potential for growth in healthcare technology is fueled by the aging population, rising healthcare costs, and the need for more efficient healthcare delivery systems.

Sustainable Investing

Sustainable investing has become increasingly important on a global scale as investors are recognizing the impact of their investments on the environment, society, and governance practices. This approach not only seeks financial returns but also aims to create a positive impact on the world.

ESG (Environmental, Social, Governance) factors are now key considerations for investors when making investment decisions. Environmental factors focus on how a company performs as a steward of the environment, social factors look at how it manages relationships with employees, suppliers, customers, and the communities where it operates, and governance factors assess the company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Successful Sustainable Investment Strategies

- Impact Investing: Investing in companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return.

- Green Bonds: Investing in bonds where the proceeds are used exclusively for climate and environmental projects.

- Sustainable Mutual Funds: Investing in mutual funds that focus on companies with strong ESG practices.

- Engagement: Engaging with companies as a shareholder to encourage better ESG practices and positive change.