Get ready to dive into the world of bond investment tips, where we break down everything you need to know to make informed decisions and maximize your returns. From understanding bond investments to building a diversified portfolio, we’ve got you covered with essential information and strategies. So buckle up and let’s explore the exciting realm of bond investing together!

In this article, we will explore the ins and outs of bond investments, covering everything from the basics to advanced strategies for managing your portfolio effectively.

Understanding Bond Investments

When it comes to bond investments, investors lend money to governments or corporations in exchange for regular interest payments and the return of the initial investment amount at a specified future date. Bonds are considered fixed-income securities, offering a more predictable income stream compared to stocks.

Types of Bonds

- Government Bonds: Issued by governments to fund public projects and operations. Examples include U.S. Treasury bonds and municipal bonds.

- Corporate Bonds: Issued by companies to raise capital for various purposes. These bonds offer higher yields but come with higher risks.

- Mortgage-Backed Securities: Backed by a pool of mortgages, these bonds provide investors with exposure to the real estate market.

Risks and Mitigation Strategies

- Interest Rate Risk: Bond prices and interest rates have an inverse relationship. To mitigate this risk, investors can consider holding bonds until maturity or diversifying their bond portfolio.

- Credit Risk: The risk that the bond issuer may default on payments. Investing in bonds with higher credit ratings can help reduce this risk.

- Inflation Risk: Inflation can erode the purchasing power of bond returns. Investors can consider investing in Treasury Inflation-Protected Securities (TIPS) to hedge against inflation.

Factors to Consider Before Investing in Bonds

Before diving into bond investments, there are several key factors that investors should consider to make informed decisions. Understanding these factors can help investors mitigate risks and maximize rewards in their investment portfolios.

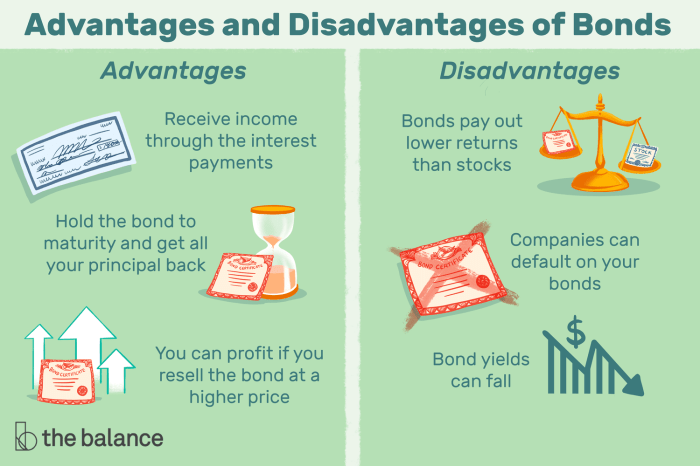

Risk and Reward Comparison

When comparing bond investments with other options, it’s essential to weigh the risks and rewards. Bonds generally offer a more stable and predictable income stream compared to stocks, making them a popular choice for conservative investors. However, the potential returns from bonds are typically lower than those from stocks or other riskier investments. It’s crucial to assess your risk tolerance and investment goals before deciding on the right mix of investments for your portfolio.

Impact of Interest Rates

Interest rates play a significant role in bond investments. When interest rates rise, bond prices tend to fall, and vice versa. Investors need to be aware of these fluctuations and how they can affect the value of their bond holdings. To navigate interest rate changes, investors can consider diversifying their bond portfolio by investing in bonds with varying maturities. Short-term bonds are less sensitive to interest rate changes compared to long-term bonds, offering some protection against rising rates.

Building a Diversified Bond Portfolio

Diversification is a key strategy in building a bond portfolio to help manage risk and optimize returns. By spreading investments across different types of bonds, industries, and issuers, investors can reduce the impact of negative events on their overall portfolio performance.

The Importance of Diversification

Diversification helps to minimize the impact of any single bond or sector underperforming. It allows investors to benefit from the strengths of various bonds while reducing the risk associated with any individual investment. By spreading out investments, investors can potentially achieve a more stable and consistent return over time.

- Diversify across different bond types: Include a mix of government, corporate, municipal, and other types of bonds to spread risk.

- Vary maturities: Investing in bonds with different maturities can help manage interest rate risk. Short-term bonds are less sensitive to interest rate changes, while long-term bonds offer higher potential returns.

- Consider credit quality: Include bonds with varying credit ratings to balance risk and return. Investment-grade bonds offer lower risk but lower returns, while high-yield bonds provide higher returns but come with higher risk.

- Geographic diversification: Invest in bonds from different regions or countries to reduce exposure to local economic conditions and geopolitical risks.

Complementing Different Types of Bonds

By including a mix of bond types in a portfolio, investors can benefit from the unique characteristics of each type. For example, government bonds are considered safer investments, providing stability and income, while corporate bonds offer higher yields but come with credit risk. By combining these different types of bonds, investors can create a well-rounded portfolio that balances risk and return.

Remember, the key to building a successful bond portfolio is not just about picking winners but about creating a diversified mix that can weather various market conditions.

Tips for Managing Bond Investments

Managing bond investments effectively requires careful monitoring and decision-making to maximize returns and minimize risks.

The Role of Bond Duration and Yield

Bond duration and yield are critical factors in managing a bond portfolio. Duration measures a bond’s sensitivity to interest rate changes, while yield indicates the return on investment. Balancing these two factors is essential for a successful bond investment strategy.

- Consider the impact of interest rate changes on bond prices. Longer duration bonds are more sensitive to interest rate fluctuations, which can affect the overall value of the portfolio.

- Monitor the yield curve to assess the relationship between short-term and long-term bond yields. An inverted yield curve, where short-term yields are higher than long-term yields, may signal an economic downturn.

- Adjust the portfolio duration based on interest rate expectations. In a rising rate environment, consider shorter duration bonds to minimize potential losses.

Timing to Buy, Sell, or Hold Bonds

Knowing when to buy, sell, or hold bonds is crucial for optimizing portfolio performance and achieving investment goals.

- Buy bonds when interest rates are expected to decrease, leading to higher bond prices and capital gains.

- Sell bonds when interest rates are forecasted to rise, as bond prices may decline. This can help lock in profits before potential losses occur.

- Hold bonds during stable interest rate environments to benefit from consistent income and avoid unnecessary trading costs.