Building a diversified investment portfolio sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Diving into the world of diversified investment portfolios is like exploring a treasure trove of financial opportunities, where each asset class plays a unique role in shaping your investment journey.

Importance of Diversification

Investing can be a tricky game, but one key strategy to success is diversification. Diversification is the practice of spreading your investments across different asset classes, industries, and geographic regions to reduce risk and maximize returns.

Benefits of Diversified Investment Portfolio

- Diversification helps reduce the impact of volatility in any one particular investment. If one asset class is underperforming, other investments in your portfolio can help balance out the losses.

- By diversifying, you can potentially increase your chances of earning higher returns over the long term. Different assets perform well at different times, so having a mix of investments can help capture opportunities for growth.

- It also helps protect your portfolio from systemic risks. For example, if a particular industry or sector faces a downturn, having diversified investments can shield your overall portfolio from significant losses.

Risk Management and Return Maximization through Diversification

Diversification is the only free lunch in finance.

When you diversify your investments, you are essentially spreading your risk across multiple assets, which can help reduce the impact of any single investment’s poor performance. This risk management strategy is crucial in protecting your hard-earned money from significant losses.

Moreover, diversification can also help maximize your overall returns. By investing in a mix of assets with different levels of risk and return potential, you can create a balanced portfolio that aims to achieve optimal returns for your risk tolerance level.

Remember, the key to successful investing is not putting all your eggs in one basket. Diversification is a powerful tool that can help you navigate the ups and downs of the market while working towards your financial goals.

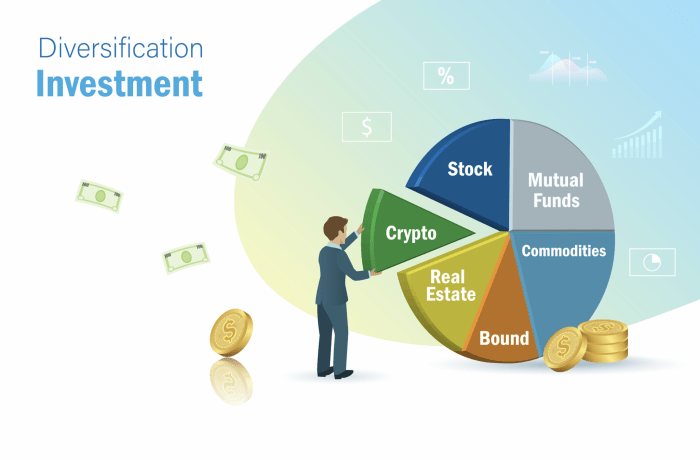

Types of Assets for Diversification

When building a diversified investment portfolio, it’s essential to consider different types of assets to spread risk and maximize returns.

Stocks

- Ownership in a company

- Potential for capital appreciation

- Riskier than bonds but offer higher returns

Bonds

- Debt securities issued by governments or corporations

- Provide steady income through interest payments

- Generally less risky than stocks

Real Estate

- Physical property like residential or commercial buildings

- Can generate rental income and appreciate in value

- Considered a hedge against inflation

Commodities

- Raw materials like gold, oil, and agricultural products

- Act as a hedge against inflation and currency fluctuations

- Can be volatile but offer diversification benefits

Cryptocurrencies

- Digital assets like Bitcoin and Ethereum

- Decentralized and not tied to traditional financial systems

- Highly volatile but have the potential for significant growth

Risk Management Strategies

Investing in a diversified portfolio can help reduce specific risks associated with individual investments. By spreading your money across different asset classes and industries, you can minimize the impact of a single investment’s poor performance on your overall portfolio. This strategy is based on the principle that not all assets will move in the same direction at the same time.

Correlation between Assets and Portfolio Risk

The correlation between assets in your portfolio is crucial for effective risk management. Assets that have a low or negative correlation tend to move independently of each other, providing diversification benefits. On the other hand, assets with a high positive correlation may move in the same direction, increasing portfolio risk.

- Asset Allocation: Properly allocating your investments across different asset classes, such as stocks, bonds, real estate, and commodities, can help reduce risk. This strategy ensures that your portfolio is not overly exposed to a single type of asset.

- Rebalancing: Regularly reviewing and adjusting your portfolio to maintain your desired asset allocation is essential for effective risk management. Rebalancing involves selling assets that have performed well and buying assets that have underperformed to maintain the desired risk-return profile.

Building a Balanced Portfolio

Balancing risk and return objectives is crucial when designing a portfolio. It involves organizing the allocation percentages for different asset classes while considering investment goals and risk tolerance.

Sample Portfolio Allocation

When building a balanced portfolio, it’s essential to diversify across various asset classes to minimize risk. Here’s a sample allocation:

- Stocks: 40%

- Bonds: 30%

- Real Estate: 20%

- Commodities: 10%

Remember, the allocation percentages can vary based on individual preferences and market conditions.

Tailoring the Portfolio

Tailoring the portfolio involves adjusting the asset allocation to align with specific investment goals and risk tolerance. For example:

- Conservative investors may increase bond allocation for stability.

- Aggressive investors may focus more on stocks for higher returns.

Monitoring and Adjusting

Regularly monitoring a diversified investment portfolio is crucial to ensure that it continues to align with your financial goals and risk tolerance. By keeping a close eye on the performance of your investments, you can identify any areas that may need adjustment and take appropriate action to maintain a balanced portfolio.

Key Indicators to Track

- Asset Allocation: Monitor the percentage of your portfolio allocated to different asset classes such as stocks, bonds, real estate, and commodities.

- Portfolio Return: Keep track of the overall return on your investments to assess how well your portfolio is performing compared to your expectations.

- Risk Exposure: Evaluate the level of risk in your portfolio and ensure it remains within your risk tolerance by analyzing metrics such as standard deviation and beta.

- Diversification: Verify that your investments are spread across various sectors and industries to reduce concentration risk.

Strategies for Adjusting

- Rebalancing: Periodically reallocate your assets to maintain the desired asset allocation, selling overperforming assets and buying underperforming ones.

- Market Conditions: Adjust your portfolio based on changing market conditions, such as economic trends, interest rate movements, and geopolitical events.

- Financial Goals: Modify your investment strategy to align with changes in your financial goals, risk tolerance, time horizon, or liquidity needs.

- Professional Advice: Seek guidance from financial advisors or investment professionals to make informed decisions about adjusting your portfolio.