Investment research tools set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Get ready to dive into the world of investment research tools and discover how they can revolutionize your decision-making process.

Overview of Investment Research Tools

Investment research tools play a crucial role in helping investors make informed decisions when it comes to managing their portfolios. These tools provide valuable insights, analysis, and data that can guide investors in navigating the complex world of finance.

Popular Investment Research Tools

- 1. Bloomberg Terminal: A comprehensive platform offering real-time data, news, and analysis for financial professionals.

- 2. Morningstar: Known for its detailed research reports, fund analysis, and portfolio tracking tools.

- 3. Yahoo Finance: Provides a wide range of financial data, news, and charting tools for individual investors.

Analyzing Market Trends and Making Strategic Decisions

Investment research tools help investors analyze market trends by providing historical data, technical analysis, and financial ratios. By utilizing these tools, investors can identify potential opportunities, assess risks, and make strategic decisions that align with their investment goals.

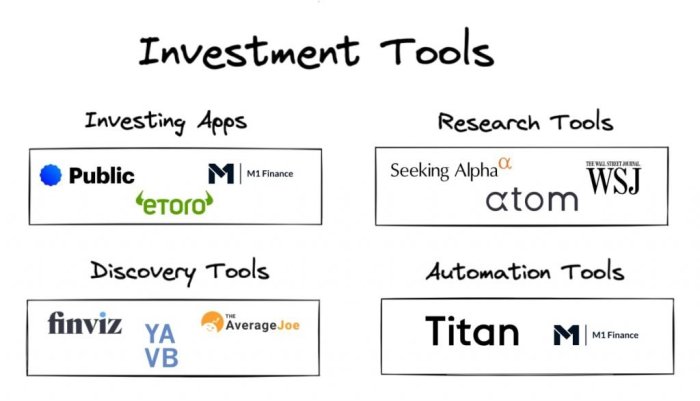

Types of Investment Research Tools

Investment research tools can be broadly categorized into fundamental analysis tools, technical analysis tools, data visualization tools, and screening/filtering tools. Each of these plays a crucial role in helping investors make informed decisions and identify potential investment opportunities.

Fundamental Analysis Tools vs. Technical Analysis Tools

Fundamental analysis tools focus on evaluating the intrinsic value of a security by analyzing various economic, financial, and qualitative factors. This includes examining financial statements, earnings reports, industry trends, and competitive positioning. On the other hand, technical analysis tools rely on historical price and volume data to forecast future price movements. This involves studying charts, patterns, and indicators to identify trends and patterns in market behavior.

Role of Data Visualization Tools in Investment Research

Data visualization tools help investors interpret complex financial data and trends by presenting them in visual formats such as charts, graphs, and heat maps. These tools make it easier to identify patterns, correlations, and anomalies in the data, enabling investors to make more informed decisions based on data-driven insights.

Significance of Screening and Filtering Tools

Screening and filtering tools are essential for investors to efficiently sift through large volumes of securities and identify potential investment opportunities that meet specific criteria. These tools allow investors to set parameters based on financial metrics, industry sectors, market capitalization, and other factors to narrow down their search and focus on securities that align with their investment goals and risk tolerance.

Features and Functions of Investment Research Tools

Investment research tools offer a variety of features and functions that can help investors make informed decisions and manage their portfolios effectively.

Real-Time Data Updates and Portfolio Tracking

- Real-time data updates: Investment research tools provide real-time market data, news, and price updates to ensure that investors have the most current information at their fingertips.

- Portfolio tracking: These tools allow investors to track the performance of their investments, monitor changes in asset allocation, and evaluate the overall health of their portfolios.

Risk Assessment Tools

- Risk evaluation: Investment research tools offer risk assessment tools that help investors evaluate the risk associated with different investment options. These tools analyze factors such as volatility, historical performance, and correlation to assess the level of risk involved.

- Diversification analysis: Some tools also provide diversification analysis to help investors spread their risk across a variety of assets and minimize potential losses.

Customization Options

- Individual preferences: Investment research tools often come with customization options that allow investors to tailor their analysis according to their individual preferences. This includes setting specific investment goals, risk tolerance levels, and performance benchmarks.

- Alert notifications: Some tools offer alert notifications for significant market events, changes in stock prices, or portfolio performance, enabling investors to stay informed and make timely decisions.

Benefits of Using Investment Research Tools

Investment research tools offer a range of benefits that can help investors make informed decisions, save time, and stay ahead of market trends. Let’s explore some of the advantages of using these tools.

Time-Saving and Efficiency

Investment research tools streamline the process of gathering and analyzing data, saving investors valuable time. By automating tasks such as data collection, performance analysis, and risk assessment, these tools allow investors to focus on making strategic decisions rather than getting bogged down in manual research.

- Example: A stock screener tool can quickly filter through thousands of stocks based on specific criteria set by the investor, saving hours of manual research time.

- Example: Automated portfolio management tools can rebalance portfolios based on market conditions, ensuring optimal performance without the need for constant monitoring.

Improved Decision Accuracy

Investment research tools utilize advanced algorithms and data analysis techniques to provide investors with accurate and reliable information. By leveraging these tools, investors can make well-informed decisions based on data-driven insights rather than relying on gut feelings or speculation.

- Example: Risk assessment tools can analyze the historical performance of investments and provide risk-adjusted return metrics, helping investors assess the potential downside of their investment decisions.

- Example: Machine learning algorithms can analyze market trends and patterns to predict future price movements, giving investors a competitive edge in their decision-making process.

Market Trends and News Updates

Investment research tools offer real-time access to market trends, news updates, and economic indicators, enabling investors to stay informed and react quickly to changing market conditions. By staying updated with the latest information, investors can adjust their strategies and make timely decisions to capitalize on emerging opportunities or mitigate risks.

- Example: News aggregation tools can curate relevant financial news from various sources and provide personalized updates to investors, keeping them informed about market developments that may impact their investments.

- Example: Economic calendar tools can track important events such as interest rate decisions, GDP releases, and unemployment reports, allowing investors to anticipate market reactions and adjust their portfolios accordingly.