Diving into the realm of Types of financial investments, this intro sets the stage for an exciting journey through the diverse world of investment opportunities. From traditional options to alternative choices, we’re about to uncover the secrets of building a robust investment portfolio.

Types of financial investments

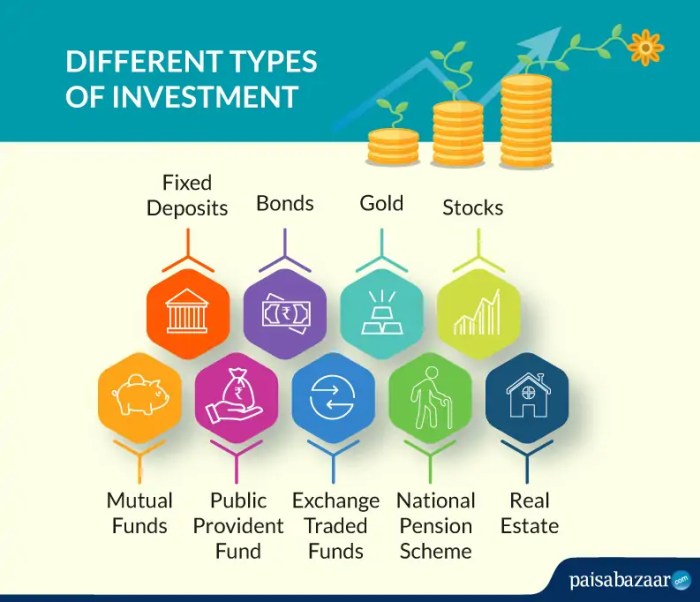

Financial investments involve putting money into assets with the expectation of generating income or profit over time. This can include stocks, bonds, real estate, and more.

Categories of financial investments

- Stocks: Ownership in a company that can increase in value over time.

- Bonds: Loans to a company or government in exchange for periodic interest payments.

- Mutual Funds: Pooled funds from various investors to invest in a diversified portfolio.

- Real Estate: Ownership of property for rental income or capital appreciation.

- Commodities: Investing in physical goods like gold, oil, or agricultural products.

Importance of diversifying investment portfolios

Diversification is crucial in reducing risk in an investment portfolio by spreading investments across different asset classes. This helps to mitigate the impact of a decline in one sector by potentially benefiting from gains in another. By having a mix of investments, individuals can achieve a balance between risk and return, ultimately improving the overall performance of their portfolio.

Traditional investment options

When it comes to traditional investment options, there are a few key choices that many investors consider. These options include stocks, bonds, and mutual funds. Each of these options comes with its own set of risks and potential returns, so it’s important to understand the characteristics of each before making any investment decisions.

Stocks

Stocks represent ownership in a company, and they are considered one of the riskiest traditional investment options. The value of stocks can fluctuate greatly based on the performance of the company and overall market conditions. However, stocks also have the potential for high returns, making them attractive to many investors.

Bonds

Bonds are debt securities issued by corporations or governments, and they are generally considered less risky than stocks. Bonds provide a fixed income stream through periodic interest payments and return of principal at maturity. While bonds offer more stability than stocks, they typically offer lower potential returns.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds offer investors access to professional management and diversification. The risk and return characteristics of mutual funds can vary widely depending on the underlying investments.

Liquidity of traditional investment options

In terms of liquidity, stocks are generally the most liquid of the traditional investment options. Stocks can be bought and sold easily on stock exchanges, allowing investors to quickly convert their holdings into cash if needed. Bonds can also be relatively liquid, especially those traded on major exchanges. Mutual funds, on the other hand, may have restrictions on redemption, making them less liquid compared to individual stocks and bonds.

Alternative investment options

Alternative investment options are non-traditional ways to invest money outside of stocks, bonds, and cash. These options include real estate, commodities, hedge funds, private equity, and more. They can offer investors a way to diversify their portfolios and potentially earn higher returns.

Real estate is one popular alternative investment option where investors can purchase properties to generate rental income or profit from property appreciation. Commodities, such as gold, oil, and agricultural products, can also be invested in to hedge against inflation or economic uncertainty. Hedge funds are another alternative investment option where professional managers use different strategies to achieve returns for investors.

Benefits and risks associated with alternative investment options

- Benefits:

- Higher potential returns compared to traditional investments.

- Diversification to reduce overall portfolio risk.

- Opportunities to invest in unique assets not available in traditional markets.

- Risks:

- Higher volatility and liquidity risks compared to traditional investments.

- Lack of transparency and regulatory oversight in certain alternative investments.

- Complexity in understanding the investment strategies and risks involved.

How alternative investments can add diversification to a portfolio

Alternative investments can add diversification to a portfolio by having low correlation with traditional asset classes like stocks and bonds. This means that when one asset class is performing poorly, alternative investments may perform differently, potentially reducing overall portfolio risk. By including alternative investments in a portfolio, investors can achieve a better balance and potentially enhance returns while managing risk effectively.

Investment vehicles

Investment vehicles refer to different types of assets or financial products that individuals can use to invest their money and achieve specific financial goals.

Exchange-Traded Funds (ETFs)

ETFs are investment funds traded on stock exchanges, similar to stocks. They offer diversification and lower fees compared to mutual funds. Investors can buy and sell ETF shares throughout the trading day. ETFs can be used to achieve broad market exposure or target specific sectors.

Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-generating real estate across a range of property sectors. Investors can buy shares in publicly traded REITs, providing access to real estate investments without owning physical properties. REITs offer high dividend yields and potential for capital appreciation.

Options

Options are derivative contracts that give investors the right, but not the obligation, to buy or sell an underlying asset at a specified price before a certain date. Options can be used for hedging, speculation, or generating income. They offer leverage and flexibility, but also carry high risks and complexities.