Diving into Peer-to-peer lending, this introduction immerses readers in a unique and compelling narrative that explores the ins and outs of this innovative financial model. From disrupting traditional lending practices to empowering individuals, peer-to-peer lending is reshaping the way we think about borrowing and investing.

Get ready to uncover the secrets behind this game-changing concept and discover how it’s revolutionizing the financial landscape.

Overview of Peer-to-peer lending

Peer-to-peer lending, often referred to as P2P lending, is a method of borrowing and lending money without the involvement of traditional financial institutions like banks. In this type of lending, individuals or “peers” can lend money directly to other individuals or businesses through online platforms, cutting out the middleman.

Popular Peer-to-peer lending platforms

- LendingClub: One of the largest P2P lending platforms, connecting borrowers with investors looking to make a return on their investment.

- Prosper: Another well-known platform that allows individuals to invest in personal loans.

- Upstart: Focuses on personal loans using artificial intelligence to assess creditworthiness.

Benefits and risks of Peer-to-peer lending

- Benefits:

- Higher returns for investors compared to traditional savings accounts.

- Access to funds for borrowers who may not qualify for traditional loans.

- Faster approval process and lower interest rates for borrowers.

- Risks:

- Default risk – borrowers may not repay the loan, causing investors to lose money.

- Lack of regulation compared to traditional financial institutions.

- Potential for fraud or identity theft on online platforms.

How Peer-to-peer lending works

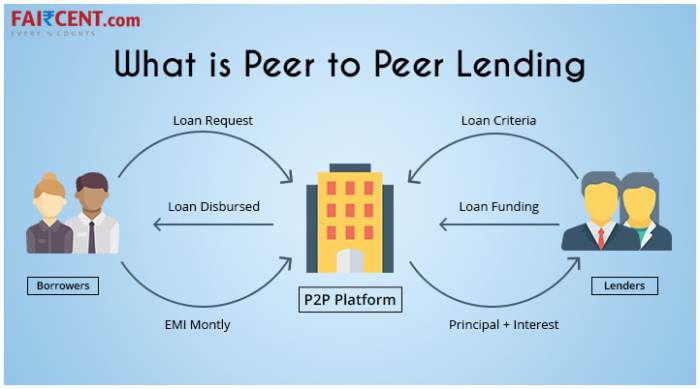

Peer-to-peer lending works by connecting individual lenders with borrowers through online platforms. Here’s a breakdown of the process and key players involved:

Process of Peer-to-peer lending

Peer-to-peer lending starts with borrowers applying for a loan on a P2P platform. Lenders then review these loan requests and decide whether or not to fund them. Once a loan is funded, the borrower receives the money and starts making repayments, including interest. The platform facilitates the entire process, including payment collection and distribution to lenders.

Key players in Peer-to-peer lending

1. Borrowers: Individuals or small businesses seeking loans.

2. Lenders: Individuals or institutional investors willing to fund loans for returns.

3. P2P Platforms: Online platforms that connect borrowers and lenders, manage transactions, and assess creditworthiness.

4. Credit Agencies: Provide credit scores and reports to assess borrower risk.

5. Collection Agencies: Step in if borrowers default on payments.

Comparison with Traditional Lending

– In traditional lending, banks or financial institutions act as intermediaries between borrowers and lenders, while P2P lending directly connects them.

– P2P lending often offers lower interest rates to borrowers and higher returns to lenders compared to traditional banks.

– Traditional lenders have stricter eligibility criteria, while P2P platforms may be more flexible in approving loans based on various factors.

– P2P lending transactions are typically faster and more transparent than traditional lending processes.

Regulation and Legal Considerations

When it comes to peer-to-peer lending, there are important regulations and legal considerations that borrowers and lenders need to be aware of. These rules and laws play a crucial role in shaping the industry and ensuring the safety of all parties involved.

Regulatory Environment

- Peer-to-peer lending platforms are typically regulated by financial authorities in each country to protect investors and borrowers.

- Regulations may include minimum capital requirements for platforms, transparency standards, and restrictions on who can participate as lenders or borrowers.

- Regulatory bodies often monitor and oversee these platforms to prevent fraud, money laundering, and other illegal activities.

Legal Considerations

- Borrowers should carefully read and understand the terms and conditions of the loan agreement before committing to a peer-to-peer loan.

- Lenders should be aware of the risks involved in peer-to-peer lending, such as the possibility of default by borrowers.

- Both borrowers and lenders should follow the legal requirements related to taxation and reporting of income from peer-to-peer lending activities.

Impact of Regulations

- Regulations can help build trust and credibility in the peer-to-peer lending industry, attracting more participants and investment.

- However, excessive regulations can stifle innovation and limit the growth potential of peer-to-peer lending platforms.

- Adapting to changing regulations is essential for platforms to remain compliant and continue operating in a competitive market.

Risks and Challenges

Peer-to-peer lending, like any other form of investment, comes with its own set of risks and challenges. It is important for both borrowers and lenders to be aware of these potential pitfalls in order to make informed decisions.

Risk of Default

Default risk is one of the biggest concerns for lenders in peer-to-peer lending. Borrowers may fail to repay the loan, leading to financial losses for the lender. To mitigate this risk, lenders should diversify their investments across multiple borrowers to spread out the risk.

Platform Risk

Another challenge in peer-to-peer lending is the platform risk. There is a possibility that the lending platform itself may face financial difficulties or even shut down, leaving both borrowers and lenders in a difficult situation. It is crucial to choose a reputable and well-established platform to minimize this risk.

Regulatory Risk

Regulatory changes can also pose a threat to peer-to-peer lending. Shifts in laws and regulations governing the industry can impact the operations of lending platforms and the rights of borrowers and lenders. Staying informed about regulatory developments is key to navigating this risk.

Economic Fluctuations

Economic downturns can affect the ability of borrowers to repay their loans, leading to higher default rates. Lenders should consider the economic climate and adjust their investment strategies accordingly. Diversifying across different types of loans can help mitigate the impact of economic fluctuations on peer-to-peer lending platforms.