Index funds explained takes center stage in the world of investments, offering a unique approach to passive investing that is both cost-effective and efficient. Understanding how these funds operate is crucial for investors looking to diversify their portfolios and maximize returns. This guide delves into the intricacies of index funds, shedding light on their benefits, workings, and considerations for potential investors.

What are Index Funds?

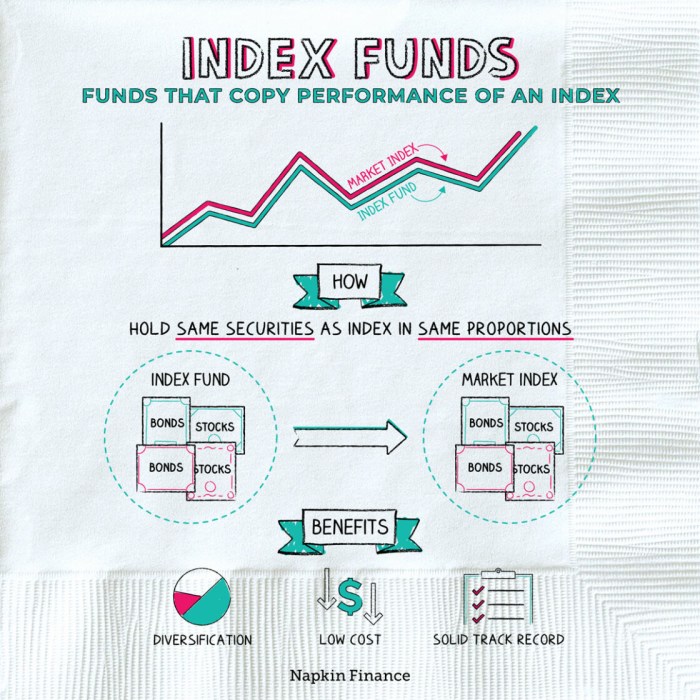

Index funds are a type of investment fund that aims to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds are designed to provide investors with broad market exposure at a low cost.

Unlike actively managed funds, which involve a fund manager making investment decisions to outperform the market, index funds are passively managed. This means that they aim to match the performance of the index they are tracking rather than trying to beat it.

Examples of Popular Index Funds

- Vanguard Total Stock Market Index Fund (VTSAX): This fund tracks the performance of the CRSP US Total Market Index, which includes nearly 100% of the investable US stock market.

- iShares Core S&P 500 ETF (IVV): This fund aims to mirror the performance of the S&P 500, which is composed of 500 of the largest companies in the United States.

- SPDR S&P 500 ETF Trust (SPY): Another fund that tracks the S&P 500, offering investors exposure to the performance of large-cap U.S. stocks.

How do Index Funds Work?

Index funds are investment funds that aim to track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds are passively managed, meaning they do not require active decision-making by a fund manager. Instead, they replicate the performance of the chosen index by holding the same stocks in the same proportions as the index itself.

Tracking a Specific Market Index

Index funds work by investing in the same securities that make up a particular index. For example, if an index fund is designed to track the S&P 500, it will hold the 500 stocks that are included in the index. This allows investors to gain exposure to a broad section of the market without having to buy individual stocks.

Benefits of Diversification

One of the main benefits of using index funds is diversification. By holding a basket of stocks that represent the overall market, investors can spread their risk across multiple companies and industries. This can help reduce the impact of poor performance from any single stock on the overall portfolio.

Buying and Selling Shares

Investors can buy and sell shares in an index fund through a brokerage account, just like they would with individual stocks. The price of the index fund shares is based on the net asset value (NAV) of the underlying securities in the fund. This makes it easy for investors to invest in a diversified portfolio with the simplicity of trading a single security.

Advantages of Investing in Index Funds

Index funds offer several advantages that make them an attractive investment option for many investors.

Low Expenses Associated with Index Funds

Index funds are known for their low expense ratios compared to actively managed funds. These low costs result from the passive management style of index funds, which aim to replicate the performance of a specific market index rather than actively selecting investments. As a result, investors benefit from lower fees, allowing them to keep more of their investment returns.

Broad Market Exposure

One of the key advantages of investing in index funds is the broad market exposure they provide. By investing in an index fund, investors gain exposure to a diverse range of securities that make up the underlying index. This diversification helps reduce risk by spreading investments across multiple companies and sectors, thereby minimizing the impact of any single stock’s performance on the overall portfolio.

Tax Efficiency of Index Funds

Index funds are known for their tax efficiency compared to actively managed funds. Since index funds have lower turnover rates due to their passive management approach, they typically generate fewer capital gains distributions. This can result in lower tax liabilities for investors, making index funds a tax-efficient investment option for those looking to minimize their tax burden.

Factors to Consider Before Investing in Index Funds

When considering investing in index funds, there are several key factors that investors should take into account to make informed decisions. It is essential to understand these factors to maximize the benefits and minimize the risks associated with index fund investments.

Risks Associated with Investing in Index Funds

Investing in index funds carries certain risks that investors should be aware of before committing their money. Some of the risks associated with index funds include:

- Market Risk: Index funds are subject to market fluctuations and overall market performance.

- Tracking Error: There may be a variance between the fund’s performance and the index it is tracking.

- Concentration Risk: Some index funds may be heavily concentrated in specific sectors or industries, exposing investors to sector-specific risks.

- Lack of Flexibility: Index funds have limited flexibility in terms of stock selection and allocation, which may hinder the fund’s ability to outperform the market.

Performance of Index Funds vs. Actively Managed Funds

When comparing the performance of index funds to actively managed funds, several factors come into play. While index funds typically have lower fees and expenses compared to actively managed funds, they may not always outperform actively managed funds due to their passive nature. Actively managed funds rely on the expertise of fund managers to make investment decisions based on market conditions and research, which can sometimes result in higher returns but also come with higher costs.

Overall, investors should carefully consider their investment goals, risk tolerance, and time horizon before choosing between index funds and actively managed funds. It is essential to weigh the pros and cons of each type of fund and align them with individual investment objectives to make the most suitable investment decision.